Professional Liability for Doctors

(What you need to know)

As a doctor, you may be researching the ins and outs of professional liability insurance, aka medical malpractice insurance. While researching is most assuredly in your DNA as a physician, there are some areas where it's beneficial for an independent insurance agent to step in.

An independent insurance agent can aid in finding you the best coverage for a competitive price. When it comes to insuring your profession and livelihood, they are licensed and know what it takes.

Your professional liability insurance, or any other insurance you need, shouldn't be left to research and chance. It should be left to the professionals.

What Is Professional Liability Insurance for Doctors?

Professional liability insurance, referred to in a doctor's case as medical malpractice insurance, is needed when a patient files a claim against a doctor, hospital or healthcare professional due to alleged negligence or omission of care.

This normally happens when a patient has long-term or short-term effects of treatment caused by a physician or hospital, such as injury, disease or even death due to care performed or lack thereof.

This refers to your livelihood as a doctor, so it's pretty big stuff. And it's a lot to protect should the worst happen. It can even be as simple as a family member of a deceased or injured patient claiming that the care you recommended caused death or injury.

Even if you are found free and clear, you still have to pay to represent yourself and fight for your side. That's where a medical malpractice policy will come into play, and even more, a good independent insurance agent.

What's the Cost of Medical Malpractice Insurance?

So the bottom line is: It depends. Are you a risky heart surgeon, where death and hard calls knock at your door on a consistent basis? Or are you a foot doctor where death may be a little less common?

To the insurance company, you are a set of risk factors that are assigned dollar signs depending on how risky your profession truly is.

They determine the risk by using actuaries and cold hard data, something you can respect as a doctor. If you've had a prior loss or little experience. your rates may be higher.

The exact costs can be figured out by your independent insurance agent, since they have access to all the carriers and can point you in the right direction.

Other Forms of Insurance for Doctors

Understanding what types of insurance are applicable to you as a doctor depends on the nature of your practice. Finding out what your exact needs are can be done with your independent insurance agent, but for now, going over the basics is pretty good. too.

Common insurance policies that doctors can invest in:

- Medical malpractice: This coverage we've already gone over, but just in case you forgot, it's a form of professional liability insurance specific to health practitioners. It provides the coverage you need against the risk of performing a procedure incorrectly or providing medical advice that results in a patient's injury, illness or death.

- Doctor disability insurance, aka body part insurance: As a doctor you may be using parts of your body to perform treatment, such a when a surgeon uses their hands to perform surgeries. Becoming disabled or sustaining an injury to your body that prevents you from working, well, it can and does happen. Having insurance to at least keep your quality of life intact while you recover is smart, like brain surgeon smart.

- Workers' compensation insurance: Most states require all employers to have some form of workers' compensation insurance when they have employees. While it may seem like another cost, this policy allows injured employees to collect wages while they’re recovering. In exchange, employees have limited rights to sue you for their injuries. See win-win for all parties.

- Business liability insurance: If a patient or another client suffers an accident on your property, you could be held responsible for bodily injuries. Fortunately, they will be in good hands because they are already in medical care, but they can still sue you for injuries, so it's best to be prepared.

- Umbrella liability insurance: This is extra liability insurance that works on top of your primary liability policies, think an actual umbrella, are you picturing it? Great, now put all your other policies under that umbrella. Following so far? Next, that "umbrella," aka umbrella liability insurance, will pay above and beyond for claims that exhaust the underlying policy limits.

- Property coverage: This policy will help cover any damage that your office building suffers from severe weather, fire, theft, or vandalism. It can also provide coverage for other property such as special doctor equipment, office gear and more.

The Importance of Medical Malpractice Insurance

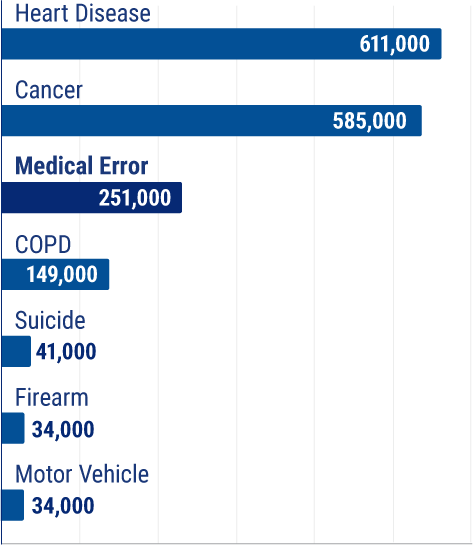

Considering that medical malpractice deaths are in the top 5 leading causes of death in the United States, you should probably have insurance. While you're out trying to save lives and prevent the leading disease killers, malpractice deaths are at the top of that list.

Medical Errors Nation's Third Biggest Killer

Source: Martin Makary, Michael Daniel study at Johns Hopkins University School of Medicine

While your general liability insurance will protect you if a patient slips and falls, your malpractice policy will protect you specifically from claims arising from the treatment of your patients.

If a patient believes that you’ve been negligent in your care, whether it’s physical treatment or even professional advice, you could be held responsible for the resulting damages.

A malpractice lawsuit is very expensive and likely to put you out of business if you're not prepared. Part of being proactive is getting proper counsel. An independent insurance agent can help offset the cost involved in medical malpractice insurance by looking at multiple carrier options.

They can scour the vast possibilities for you so you don't have to waste precious time that could be used to save a life instead of finding insurance.

Benefits of an Independent Insurance Agent

If you’re looking for medical malpractice insurance or any other doctor-related policies to run your business, you have lots of options. Just as you come highly recommended to treat patients, so does an independent insurance agent for your coverage.

An independent insurance agent works for you. They have your best interests in mind, and can advise you about all things insurance for your practice. Getting protected has never been easier, and making sure you're covered so you can go on taking care of patients is doable with the right trusted advisor by your side.