Illinois Restaurant Insurance

Protect against liability in the Windy City, you're on your own with the political corruption.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Illinois is in the heart of the Midwest. That means deep-fried food, lots of frozen food, deep dish pizza (hello, Chicago) and other things that will affect your restaurant insurance in Illinois. The beauty of restaurant insurance in Illinois is that you don't have to know anything specific, either - at least, not when you work with an independent insurance agent. Independent insurance agents are your best resources to understand broad concepts, like the coverage you need and the risks that drive that coverage.

Risks in Restaurant Insurance in Illinois

Even if you and thousands of other restaurant owners are operating in Illinois, there are going to be differences based on:

- What type of food you serve

- How you prepare/cook the food

- The building you’re in

- The kitchen equipment you use

- Personal property inside the building

- Special property, like your sign or other unique add-ons

- Staff size and roles

All of these factors mean one important thing: Your restaurant insurance will be different from any other restaurant in Illinois. This is true even though the basic types of coverage you need will be the same as every other restaurant. And before you freak out thinking you'll need to know everything about restaurant insurance, breathe easy: Your independent insurance agent will have the know-how and options to take care of this for you.

Basic Coverage You’ll Need for Your Illinois Restaurant

Illinois, like almost every other state, requires basic insurance coverage for restaurants, including:

- Property insurance

- General commercial liability insurance

- Employee insurance

Let’s go through the general information and specifics for each.

Property Insurance for Restaurants in Illinois

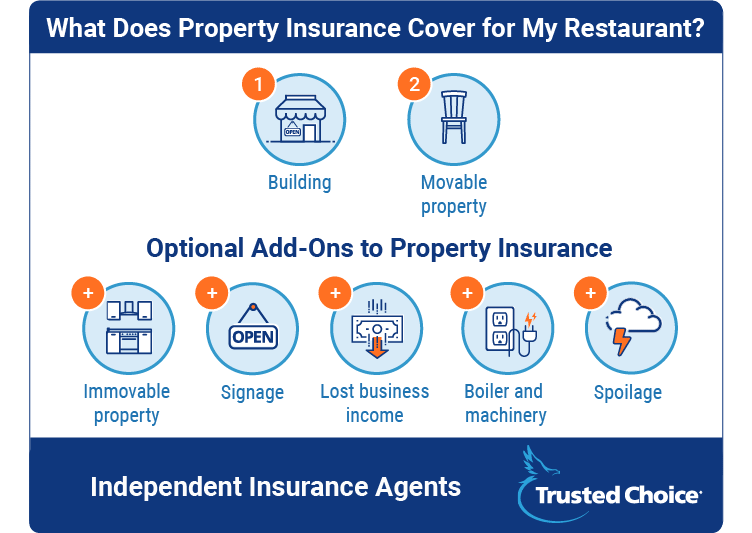

Property insurance covers the replacement value of the property. This includes:

- Your building

- Movable property in that building (think tables, chairs, utensils, etc.)

Beyond this basic coverage, you have to account for the immovable property in your restaurant. Certain kitchen equipment is typically attached to the building itself. Maybe you have special build-outs for booths or other seating/dining arrangements in your restaurant. All of this is a separate issue from movable property and should be discussed with your independent insurance agent to determine what additional coverage you need and for how much. The building and some (but perhaps not all, without additional coverage for immovable property) of the property inside are covered by general property insurance. However, you’ll need special coverage for other common items or issues, such as:

- Lost business income: If you have a covered loss, lost business income means your business keeps receiving money while you’re shut down. If there’s a kitchen fire, lost business income coverage means you continue to get money while you’re closed to pay employees and other expenses.

- Signage: Do you have a fancy sign? Lots of restaurants do, and some cost around $100,000 (or more). If you want your sign covered, you’ll need additional coverage. Likewise, if you have a drive-through sign, you'll need additional coverage for that.

- Boiler and machinery equipment: Equipment can break down and cause damage. Equipment coverage doesn’t cover the cost of the equipment itself, but any damage that a breakdown causes. This is typically true if there is an electric wiring problem or HVAC shutdown that causes further damage to other systems in the restaurant.

- Spoilage: If a refrigerator or freezer breaks down and you lose all of your food, spoilage insurance will cover the cost of that food.

You don’t have to purchase all of these specialty property insurance coverage policies. Maybe you don’t have an expensive sign, or maybe you aren’t too concerned about potential electrical damage. In contrast, some banks require lost business income coverage to secure loans. Spoilage should also be a non-negotiable policy, especially if you keep a lot of food on hand.

General Commercial Liability Insurance for Restaurants in Illinois

Just like there is general and specialized property coverage for your Illinois restaurant, there’s also general and specialized liability coverage. General commercial liability will cover your restaurant if:

- A customer suffers an injury or has an accident

- A customer becomes ill because of the food you served

There are two types of specialized liability insurance policies you should consider, too:

- Liquor liability

- Directors and officers liability

Liquor liability is a separate policy from general liability that covers incidents arising from the sale, distillation, or brewing of alcohol. So if you overserve a customer and they get into an accident, liquor liability will cover the cost of:

- Property damage

- Expenses related to bodily injury

Directors and officers liability is an even more specialized type of coverage that you might want if you’re running a restaurant with multiple locations. It protects the business entity and directors if there is a lawsuit against the restaurant for a poor business decision. Shareholders, a city, or even employees can bring this type of lawsuit against your company. The coverage pays for litigation expenses, which can be costly when cases drag out for months, if not years.

Keep in mind that general commercial liability typically has a $1 million policy limit. Liquor liability is the same, but if you serve a lot of alcohol, you may want to increase the limit to $5 million or more. Your independent insurance agent is in the best position to assess what you need and ensure that you’re getting the best deal for your particular risks and liabilities.

Employee Insurance for Restaurants in Illinois

To most restaurant owners, employee insurance means workers' compensation. However, there are also employment practices liability insurance – another type of coverage that protects your business from pricey litigation costs. Workers' compensation is required by law if you operate a restaurant in Illinois. It covers three types of expenses if an employee is injured on the job:

- Medical expenses

- Lost wages

- Costs associated with rehabilitation

Another type of insurance aimed at employee-related issues is employment practices liability insurance. It protects your restaurant and directors from the costs of litigation if an employee sues due to:

- Hostile work environment

- Sexual harassment

- Bad behavior

- Discrimination

How Various Features of Restaurants Affect Insurance Costs in Illinois

Drive-through windows, wait staff, delivery services, and other features of your Illinois restaurant can change the coverage you need and the cost of your insurance. If anything, all of these factors are good to keep in mind so you have a more realistic idea of what it’s going to cost to cover your restaurant and all of its unique features. Here are just some of the many factors you should think about:

- Buffets: Buffets create additional risk because food is sitting out and exposed, and multiple customers might touch it. This can slightly increase the cost of insurance. Underwriters tend to be biased toward increasing costs based on this fact.

- Drive-throughs: Drive-throughs seem like they may increase costs because there are additional risks from them being present in a restaurant, but this isn’t the case. Drive-through windows have no bearing on restaurant insurance unless you have a drive-up sign that costs a significant amount of money. In that case, you may want additional property coverage.

- Wait staff vs. carry-out: The biggest difference between having a sit-down restaurant and a carry-out joint is the additional staff. More employees mean more workers' compensation insurance coverage.

- Delivery: If you offer delivery, liability coverage will change. After all, if drivers are using their own vehicles, there are a lot of uncertainties that underwriters have to consider regarding the condition of the cars. If you purchase company cars, liability coverage is more affordable because underwriters can assess risks more easily, so it may be worth the investment.

Again, any of these factors will play into your coverage needs in a unique way depending on how your restaurant is structured and what you offer to customers. The basic point is to think about what you have to offer so you can inform your independent insurance agent of everything they need to know to accurately assess your needs.

How Operating a Restaurant in Illinois Affects Insurance Costs

State-by-state insurance needs are consistent, but there are two factors that can change certain types of coverage or costs:

- The type of food you serve

- How you cook it

In the Midwest, the primary concern is spoilage. Illinois isn’t near a coast, so much of the food is frozen. If the freezer breaks down in your restaurant, you’re going to lose a lot of food, if not all of it. Likewise, the Midwest has a lot of deep-fried foods. Higher risk in the kitchen means that you’ll pay more in workers' compensation, too.

How Much Does Restaurant Insurance Cost in Illinois?

It’s impossible to provide any sort of blanket estimate regarding the annual cost of your restaurant insurance in Illinois. However, the costs will be split in two ways:

- You’ll pay one annual premium for property and liability insurance

- And another annual premium for workers' compensation insurance

These two types of insurance are calculated differently. Workers' compensation is calculated by (1) payroll per $100; and (2) risk classification (because employees do different jobs with different risks).

DID YOU KNOW?

The higher the risk and the more employees, the more you’ll pay for your workers' compensation coverage.

Property and liability costs are different. Let’s examine the two extremes:

- $1,000-$1,500 annual payment: If you’re operating a corner stand for tacos or hotdogs, your annual payment could be this low. After all, there are few risks, no building, and very minimal personal property to cover.

- $100,000+ annual payment: If you operate a restaurant with multiple locations and valuable personal property inside that has high risk and a lot to lose, you’re going to pay more. Keep in mind that if you have paintings or other items of value inside the restaurant, you need an appraisal to ensure that you get the replacement value if something happens.

An independent insurance agent can help you find a happy medium in terms of coverage because most restaurants don’t fall at one of the two extremes. Most importantly, an independent insurance agent will take all of the facts that you tell them about your restaurant and translate that into the best possible coverage to make the most of what you spend.

An Independent Insurance Agent is Your Best Resource for Restaurant Insurance in Illinois

Insuring your Illinois restaurant will mean purchasing coverage for:

- Property

- Liability

- Employees

However, you are likely to need additional, specialized coverage for other parts of your restaurant, like liquor liability, your sign, and even to protect against employee-related lawsuits. An independent insurance agent is your best resource when you need to evaluate different options for coverage. With multiple insurers and in-depth knowledge of the industry, you can turn to your independent agent for knowledge and the best deal at every step of the way.