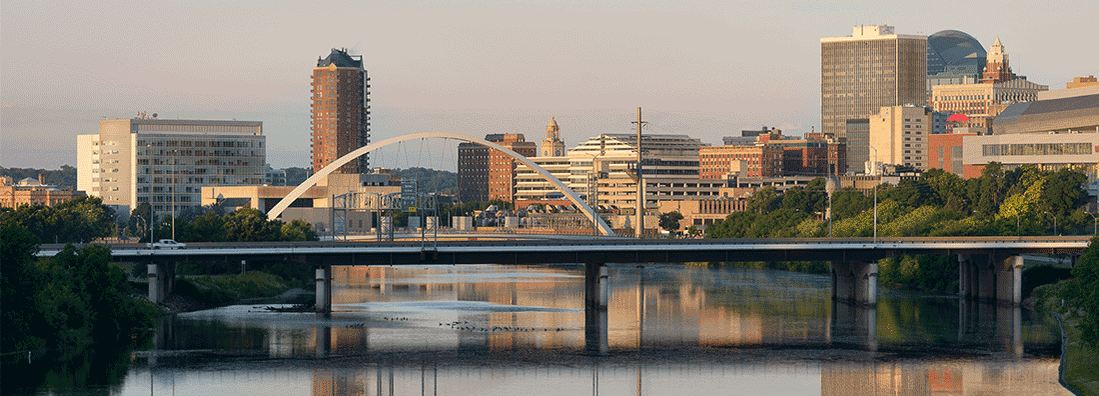

Des Moines Car Insurance

Find the right car insurance policy for you.

Des Moines is the capital of Iowa and the most populous city in the state. With congested highways and an average annual snowfall of over 35.3 inches, Des Moines residents can at times face hazardous road conditions.

Des Moines drivers need quality, affordable car insurance to protect them from the unique hazards they may encounter while driving. A Trusted Choice® Independent Insurance Agent can assess your risks and help you find a Des Moines auto insurance policy that meets your needs and budget.

Use our independent agent matching system to find the best insurance plan in your area. You tell us what you’re looking for, and our technology will recommend the best agents for you. Any information you provide will be sent to only the agents you pick. We do not sell to third parties.

Cost of Des Moines Car Insurance

Did You Know? The average cost of Des Moines car insurance is $134 per month.

Everyone’s car insurance rates are different. Your individual monthly premium is based on things like the type of car you drive, where you live, and your average annual mileage. If you are paying more than most, you might have a newer car or you might have a longer commute. If you think you are paying too much, it’s a good idea to shop around. A local independent insurance agent can get quotes from multiple insurance companies so you can find coverage that better fits your budget.

Des Moines Car Insurance Requirements

Des Moines car insurance helps you pay for vehicle damage and medical bills if you cause an accident. It can also help you repair or replace your car if it is stolen or damaged in some other way.

Iowa requires all drivers to have a minimum amount of liability coverage, but it is rarely sufficient if you are involved a serious crash.

- Bodily Injury Liability: $25,000 per person, $40,000 per accident required

- Property Damage Liability: $15,000 required

Who pays If the Accident Wasn’t My Fault?

The driver who caused the accident, of course. Approximately 8.7% of drivers in Iowa are uninsured. If they cause a crash, uninsured drivers usually can’t pay for vehicle damage and medical bills for the other drivers.

That’s why it’s so important for Des Moines drivers to purchase “uninsured motorist coverage.” It pays to fix your vehicle and pays your medical bills when you cannot collect from an uninsured driver. Some states require all drivers to purchase uninsured motorist coverage. Iowa does not require you to have uninsured motorist coverage.

What Affects the Cost of Des Moines Car Insurance?

Insurance companies base their prices on your individual risk factors. They want to know how likely you are to get into an accident or file a claim.

To determine your car insurance premium, they assess your personal characteristics (age, gender, marital status, and driving record), as well as the risks involved with your car and where you live.

The more risk factors you have, the more you will pay for car insurance.

- If you are a young driver with a history of car accidents, chances are you will pay more than your middle-aged neighbor with a clean driving record.

- If you have a long daily commute and live in an area with a high rate of auto theft, you will likely pay more for car insurance than someone who drives a short distance to work and lives in a very safe city.

Fortunately, many insurance companies offer numerous discounts to help make your policy more affordable. Your Trusted Choice agent can tell you how to maximize the discounts that you are eligible for.

More City Factors That Will Affect Your Rate:

Commute Time

It’s simple: the more time you spend on the roads, the more likely it is that you'll be in an accident. Des Moines drivers have shorter commutes than the national average, which may help to keep car insurance rates down.

National Average 25.4 minutes

Des Moines Average 18.4 minutes

Number of Car Thefts in Des Moines

- National number of thefts per 1,000 vehicles: 2.94

- Des Moines number of thefts per 1,000 vehicles: 4.52

Des Moines has a relatively high rate of auto theft compared to the U.S. overall. Car insurance may cost more for Des Moines drivers than for drivers in other cities.

Car insurance can protect you from the financial consequences of vehicle theft or a break-in. If your car is stolen, you’ll need help replacing your car and everything in it. And even a simple break-in can be costly. You’ll likely need to repair broken windows and replace stolen belongings. If you are a victim of auto theft, your car insurance can reimburse you quickly and minimize your worry.

Find Affordable Car Insurance in Des Moines

Trusted Choice Independent Insurance Agents take pride in offering quality, affordable car insurance to Des Moines residents. Our agents aren't tied down to one carrier. They can get quotes from numerous insurance companies so you have a variety of policy options.

No matter where you live or what you drive, a Trusted Choice independent agent will assess the risks you face so you can find coverage that meets your needs and budget.