California Hotel Insurance

For when the sunny skies have a rainy day

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

You’re running a hotel in the beautiful state of California, where the sun always shines and even the cows are happy. You’re also dealing with the most visited state in the US and one that continues to make the news for rapid wildfires, which is why you need some really great hotel insurance. That’s why we’ve rounded up an abundance of information on insurance in California.

As always, our independent insurance agents can help you find exactly what you need to protect yourself and those temporary beds you’re offering to millions of visitors.

What Is Hotel Insurance?

In short, hotel insurance is a set of policies designed to cover all the tricky little components involved in your hotel's operation, from your property (i.e., the building, furniture, etc.) and employees, to services offered, and your guests. Obviously, all hotels offer different amenities and frills (or lack thereof), and your business's unique assortment of risks will demand coverage tailored specifically to you.

What Types of Hotel Businesses Need Insurance?

All of them. Every business should have its property and employees protected. And in your line of work, dealing with as many customers as you do, it’s extremely important to keep your business going strong. Our independent insurance agents can help all types of hotel businesses, including:

- Premier and full service hotels: These hotels require the most comprehensive insurance packages, due to having such high occupancy spread across several hundred rooms, as well as offering tons of different services and amenities.

- Boutique hotels: With much lower occupancy rates, typically fewer than 100 rooms, and the lack of premier services or amenities (e.g., room service and fitness centers), these hotels carry less risk and don't require quite as much coverage.

- Condo hotels: These high-rise properties consist of rooms typically owned as vacation homes that are rented out for short-term stays. Coverage requirements vary, and are determined by the allotted length of guest stays, how the unit is owned (by an individual or group), and the location of the hotel (which is usually a major city).

- Hotel management companies: Employee benefits strategies that help reduce claim costs and risk management are factors in the coverage needed by these companies.

Top 5 Hotel Insurance Claims in California

While tourists may flock to California for the white sandy beaches, hiking in the world's most beautiful national parks, or trying to catch a glimpse of their favorite celebrity, the state's diverse landscape and crowded streets could lead to a variety of insurance problems for hotels.

- Fire damage: Each year more than 100,000 wildfires occur in California, burning more than 4 to 5 million acres.

- Windstorm damage: Hotels located along the 840 miles of coast in California are susceptible to high wind.

- Data breach: Cyber attacks from hackers looking for credit card information are becoming a common insurance claim for hotels.

- Liability claims: These can come in all shapes and sizes, but the most common claims are for slips and falls and stolen personal property.

- Earthquake damage: Each year southern California has about 10,000 earthquakes.

With the proper coverage in place, however, you can help minimize your risks and protect your hotel from unexpected catastrophes.

What Does Hotel Insurance Cover?

A hotel insurance policy is typically the easiest route to take when it comes to navigating the right coverage for your business. This package offers most of the liability and property coverage you'll need, and your independent insurance agent can hook you up with any additional coverage your business needs, depending on your scope of services.

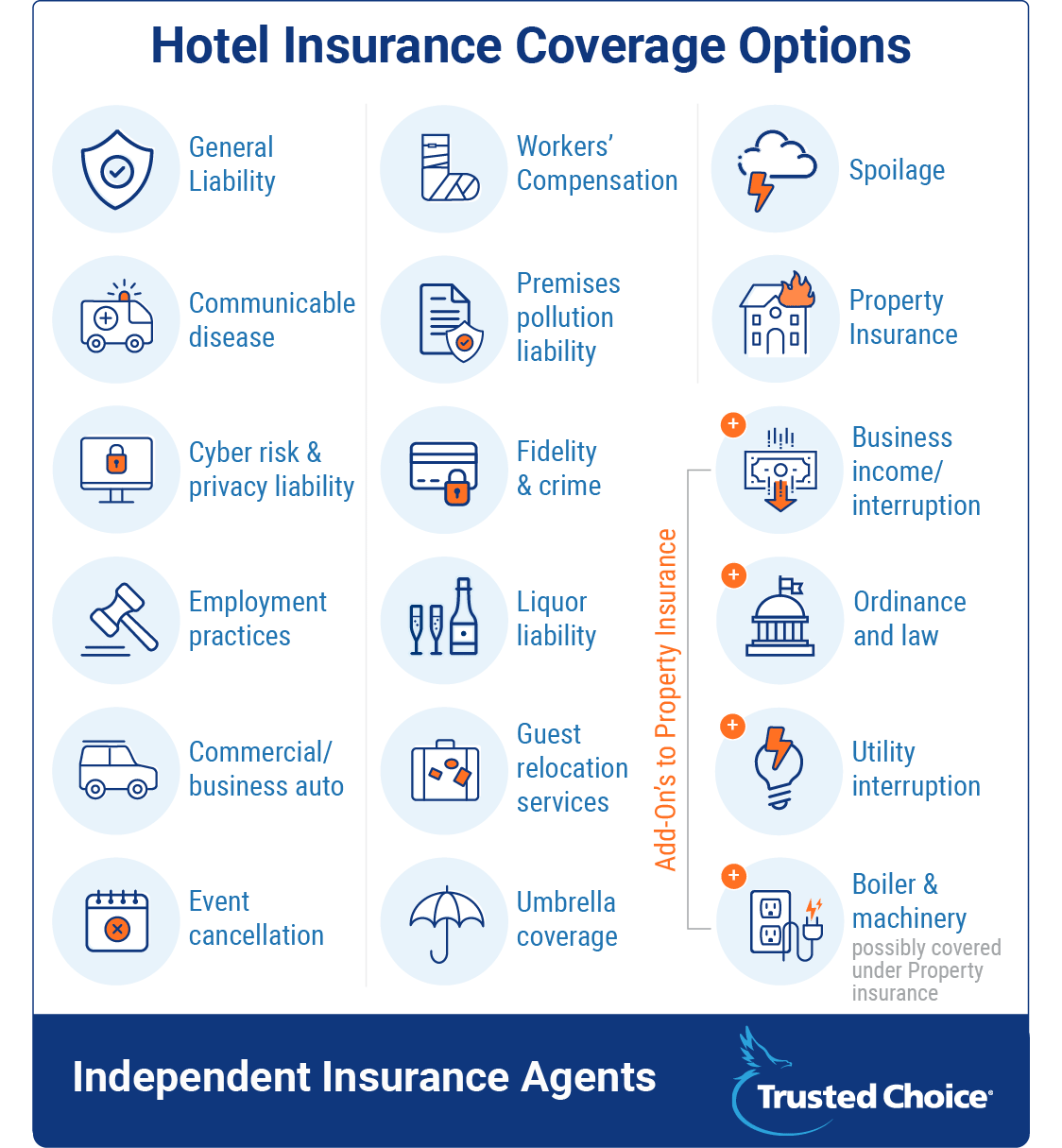

Insurance coverage options for your hotel:

- General liability: This coverage is mandatory and protects against lawsuits related to injury or property damage done by the business. Things like food poisoning claims would also fall under this category. Up to $1 million in coverage per hotel room is recommended.

- Workers' compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in California, as well as most other states.

- Property insurance: This covers any damage to your hotel's physical building, as well as the property inside it (e.g., furniture, carpeting, electronics, décor, etc.) in case of fire, etc. The type of cooking equipment used in your hotel's kitchen will contribute to the risk of fire damage, and may influence the cost of your policy. Coverage limits are typically $250 million per hotel location.

- Business income/interruption: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Flood coverage: Covers your property and any loss of income in the case of flooding.

- Wind coverage: Specifically for coastal hotels in California, wind coverage protects hotels from the high wind dangers that come with thunderstorms.

- Ordinance and law: Another part of property insurance, it covers the financial ramifications if your building is found to be behind current state codes. Handicapped-compliant features, fire safety equipment, and emergency exits are all factors here.

- Boiler & machinery: Also known as "equipment breakdown insurance," it covers electric equipment in the building (e.g., AC units, kitchen appliances, computers, etc.) that breaks down due to power surges, etc. Property insurance may cover this stuff, but not always.

- Utility interruption: An add-on to property insurance, this coverage applies to utility outages (e.g., phones, Internet, gas/electric/water, etc.) that cause damage to your property or result in a consequential loss.

- Spoilage: This coverage takes care of the replacement costs of food that spoils due to power outages caused by storms, surges, etc.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of your employees.

- Premises pollution liability: Covers medical bills and cleanup costs if one of your guests becomes ill as a result of exposure to mold or other airborne pollutants.

- Cyber risk & privacy liability: Covers the financial ramifications if your hotel suffers a data breach resulting in the compromise of your guests' personal information. Coverage limits typically run up to $2 million.

- Fidelity & crime: Covers losses due to employee theft, computer fraud, credit card fraud, and stolen/damaged property.

- Employment practices: Covers court fees, should a disgruntled employee file a claim against you.

- Liquor liability: If your employees serve too much alcohol to a customer who ends up harming other guests or your property, general liability won’t protect you. So if you serve alcohol, liquor liability coverage is a must-have.

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters.

- Guest relocation services: Covers fees required in the event that your guests must be relocated due to an on-site incident.

- Event cancellation: Covers the financial ramifications in case a scheduled event must be cancelled.

- Umbrella coverage: This coverage provides a buffer against excess liability charges that reach beyond your existing liability policies' limits. Up to $100 million in this coverage may be added.

Your hotel insurance package will be assembled by selecting the coverages that work for your unique business from a comprehensive list of available options. Coverage limits define the maximum amount an insurance company will pay out for financial losses. Coverage applies to everything from lost business revenue to potential legal/court fees.

How Much Does Hotel Insurance Cost in California?

Short answer? It depends. On a lot. An older inn near the coast might pay around $5,000/year. But a fancy high-rise hotel just a few miles away might pay as much as $1,000,000/year.

To make things even more interesting, if these same two hotels were located just 10 miles further inland, their premiums might drop by half. In another state altogether, further away from the coast, the tiny one might pay $1,200/year, while the big one might pay $150,000/year. Really, it all depends on a (large) number of factors, like:

- The age of the hotel: The older a property is, the more of a risk it is to an insurance company. Newer hotels will get more slack with their premiums. Also, the type of construction, as well as whether the building is up to current state codes, may have been influenced by the time period the hotel was constructed in.

- The location of the hotel: If the hotel is located in a region of the country prone to a certain type of natural disaster, the premium will be much higher. But costs are determined down to the specific community surrounding the hotel (if it's in a safer neighborhood, this will present less risk). Also, every state has marked flood zones in it, and these high-risk areas will have higher premiums.

- The hotel's last update/renovation: The status of the building, as well as its furnishings and security systems, will really influence the cost of coverage. The more up-to-date and up-to-code everything is, the more lenient the cost.

- The number of safety/security features: The more security/safety features a hotel has, the less risk it presents to an insurance company. Hotels with current security systems, as well as safety features like sprinkler systems and handicapped-compliant features, will be favored by an insurance company.

- The age/condition of the roof: Older/more decrepit roofs are a higher risk to the hotel guests and the building itself, and therefore more of a risk to an insurance company.

- The size of the hotel: The square footage of the hotel, as well as the number of rooms, will influence coverage costs. Obviously, more rooms mean more guests, which increases liability risk and therefore means a higher premium.

- If rooms are rented out by other companies: If the hotel has community rooms that get rented out for meetings by other companies, this will increase the liability risk, and therefore costs, as well.

- If there is cooking on the premises: Hotels with kitchens present a risk for fire damage, and hotels with cooking equipment in the guest rooms further increase that risk — by a ton. However, fire safety features in the rooms and kitchen can help to decrease this risk (and cost).

- The parking lot's security: More security features in the hotel's parking lot can reduce the risk of claims filed by guests who experience damage or theft of their vehicles.

- If there is valet parking: Valet parking is another unique feature that increases liability needs, since the guests' vehicles are literally being driven by hotel staff.

- The experience level of the management: Insurance companies are interested in all kinds of details, including how experienced the hotel's managers are. Managers with more extensive training in risk prevention/crisis response can greatly reduce claims made by the property.

- The type/number of recreational features: If a hotel has a pool or a gym, obviously the risk of injury (or even death) increases, creating a need for more coverage.

- If the hotel serves/sells alcohol: If there is alcohol on the premises, liquor liability coverage will be necessary.

- If the hotel has any existing/past claims: Just like with any other type of insurance, if a hotel has any existing/past claims, the cost of coverage will increase.

Top 5 Ways to Score Hotel Insurance Discounts in California

Preparation and knowledge are a killer mix for saving money on your hotel insurance. Here are just a few ways you can lower the cost of your premium.

- Prepare for risk: Create a risk management plan for your guests and staff and provide this plan to your insurance agent when they’re shopping for your quotes.

- Maintain your roof: Roofs are one of the most expensive things to replace, and therefore one of the most common causes of increased insurance costs. Making sure the roof of your hotel is in prime condition can help save money on your premium.

- Update your hotel: Old things are more likely to break and more costly to insure. Keep your hotel up to date and within county and state codes.

- Have safety in mind: The more effort you can put into providing a safe environment for your guests, the fewer the chances your guests have to get hurt, and the less risk you are for insurance. Some things to keep in mind are proper smoke alarms, access points from outside, elevator safety, proper food handling procedures and general organization.

- Add an indoor sprinkler system: Seeing as fire is one of the top insurance claims for hotels, equipping your hotel with an indoor sprinkler system can reduce your premium.

How to Find and Compare Hotel Insurance Quotes in California

From basic packages for your average hotel, to detailed policies that include add-ons and cover unthinkable risks, our independent insurance agents will shop companies and quotes to find you the hotel insurance that best fits your needs. Basically, they’ll make sure your business, your employees, your guests, and yourself are 100% covered, so all you have to worry about is providing a memorable experience for travelers.

https://generalliabilityinsure.com/hotel-motel-insurance-california.html

http://whitneyoaksinsurance.com/business-insurance/hotel-insurance

https://www.insurancejournal.com/news/west/2018/11/13/507414.htm