New Jersey Hair Salon Insurance

What you need to know

Jeff Green has held a variety of sales and management roles at life insurance companies, Wall street firms, and distribution organizations over his 40-year career. He was previously Finra 7,24,66 registered and held life insurance licenses in multiple states. He is a graduate of Stony Brook University.

New Jersey has roughly 884,049 small businesses in existence, adding to the state's growth. When you own a company, there are many items you'll have to consider before running a smooth operation. New Jersey business insurance can help protect your hair salon from all the what-ifs.

Fortunately, a New Jersey independent insurance agent has a network of carriers, giving you the best options on coverage and price. Since they do the shopping for free, it's a no-brainer. Connect with a local expert to get started today.

What Is Hair Salon Insurance?

Whether you own the hottest salon in New Jersey or a one-chair operation, coverage is vital to staying in business. There are several policy options when it comes to your hair salon insurance. Most include property, liability, and employee policies.

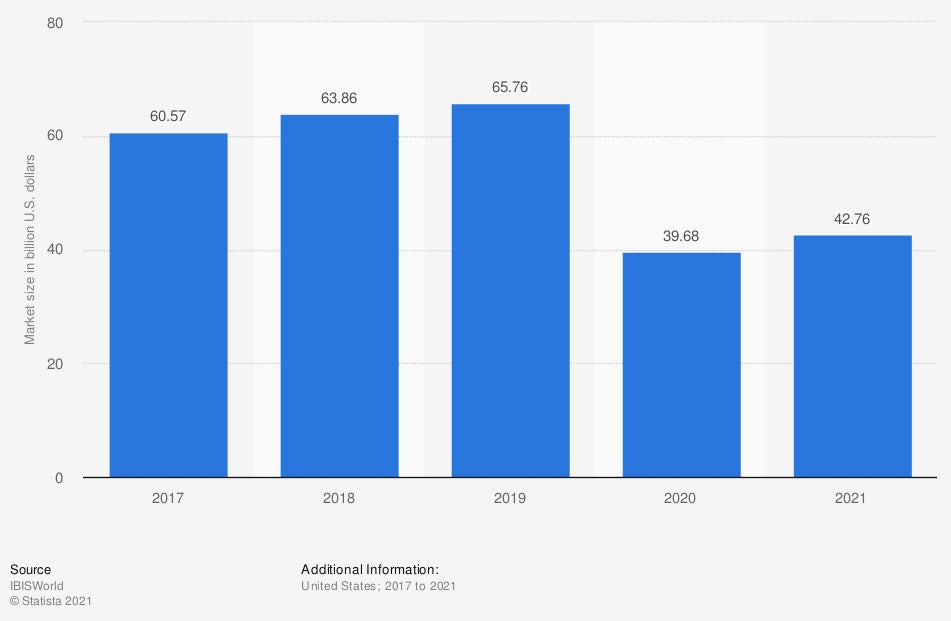

Market size of beauty salons in the US in recent years (in billion US dollars)

The beauty and grooming industries are booming no matter where you live. If you are lucky enough to be a part of it, you'll need proper protection.

What Does Hair Salon Insurance Cover in New Jersey?

In New Jersey, $13,470,081,000 in commercial insurance claims were paid in one recent year alone. This means that having the right coverage for your hair salon is crucial. Check out the standard business policies you will want to consider.

- General liability insurance: Pays for bodily injury or property damage claims where you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for building, equipment, and inventory damage from a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

- Workers' compensation insurance: Pays for an employee's medical expenses resulting from an injury or illness on the job.

- Errors and omissions insurance: Pays for negligence, personal injury, and consulting lawsuits of a client.

How Much Is Hair Salon Insurance in New Jersey?

The cost of insurance for your New Jersey hair salon will vary. Each business has different risk exposures, which makes your policies and premiums unique. Check out what carriers use when calculating your hair salon coverage.

- Prior claims reported

- Number of years in the industry

- If you have employees

- If you have safety practices

- The value of property owned

- Inventory value

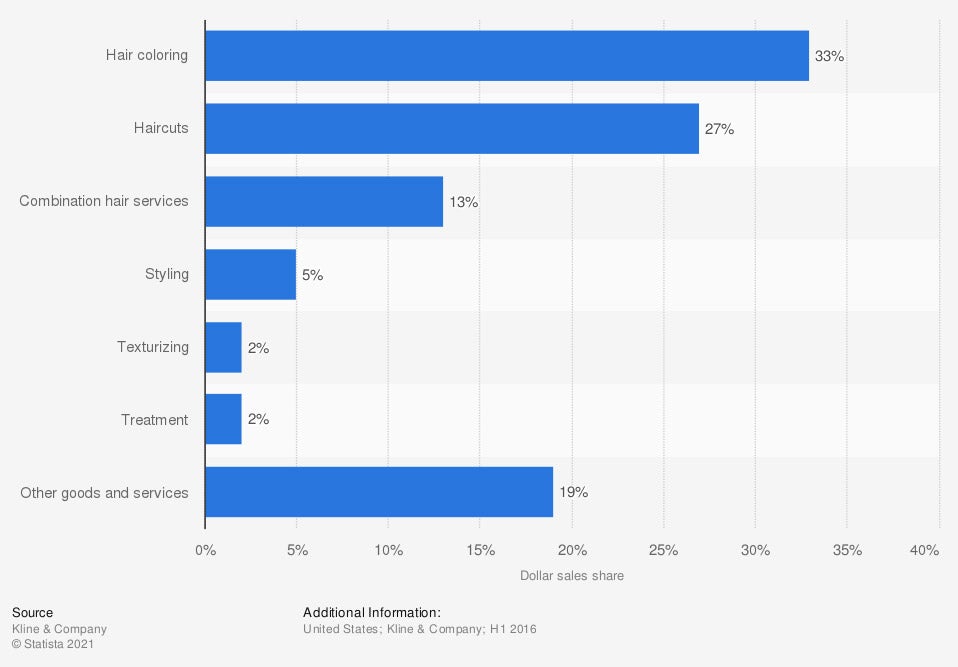

Distribution of dollar sales of hair services at salons in the US in recent years

The types of services your salon offers will impact your insurance pricing as well. The riskier your operation, the more premiums will be.

Will My New Jersey Location Impact My Rates?

Where you decide to lay down roots in New Jersey will impact your insurance premiums. Your hair salon will be rated on the following location-related factors.

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

How an Independent Insurance Agent Can Help in New Jersey

The best coverage for your New Jersey hair salon can come in many forms. There are numerous policy and price options, making it difficult to know where to turn. Fortunately, a licensed professional can review your coverage for free.

A New Jersey independent insurance agent has a network of local carriers so that you're fully protected from all the what-ifs. They even do the shopping for you, making it super easy. Connect with an expert on trustedchoice.com in no time.

https://www.statista.com/statistics/296193/revenue-hair-and-nail-salons-in-the-us/

https://www.statista.com/statistics/778104/hair-service-sales-share-us/

http://www.city-data.com/city/New-Jersey.html