North Dakota Restaurant Insurance

Houston, we've got more than wheat to worry about.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

If you’re reading this, you’re probably opening a restaurant in North Dakota. Or it’s your dream. But it doesn’t really matter which is which, because either way, you’re going to need an independent insurance agent.

Why, you wonder aloud? Because an independent insurance agent will help protect your building, your customers, and your employees. It doesn’t matter what kind of food you serve, or how you serve it, it’s time to get insured.

What Is Restaurant Insurance?

Restaurant insurance is coverage for everything you need to purchase to get your place off the ground. This includes your property, risks (typically to customers, but also third parties in the case of alcohol-related accidents), and employees.

While there is a lot to worry about, your independent agent will make sure all of your property, risks, and anything else is covered. And to work with them best, having some background knowledge is key. That's where this article comes in.

Cover Your North Dakota Restaurant’s Property

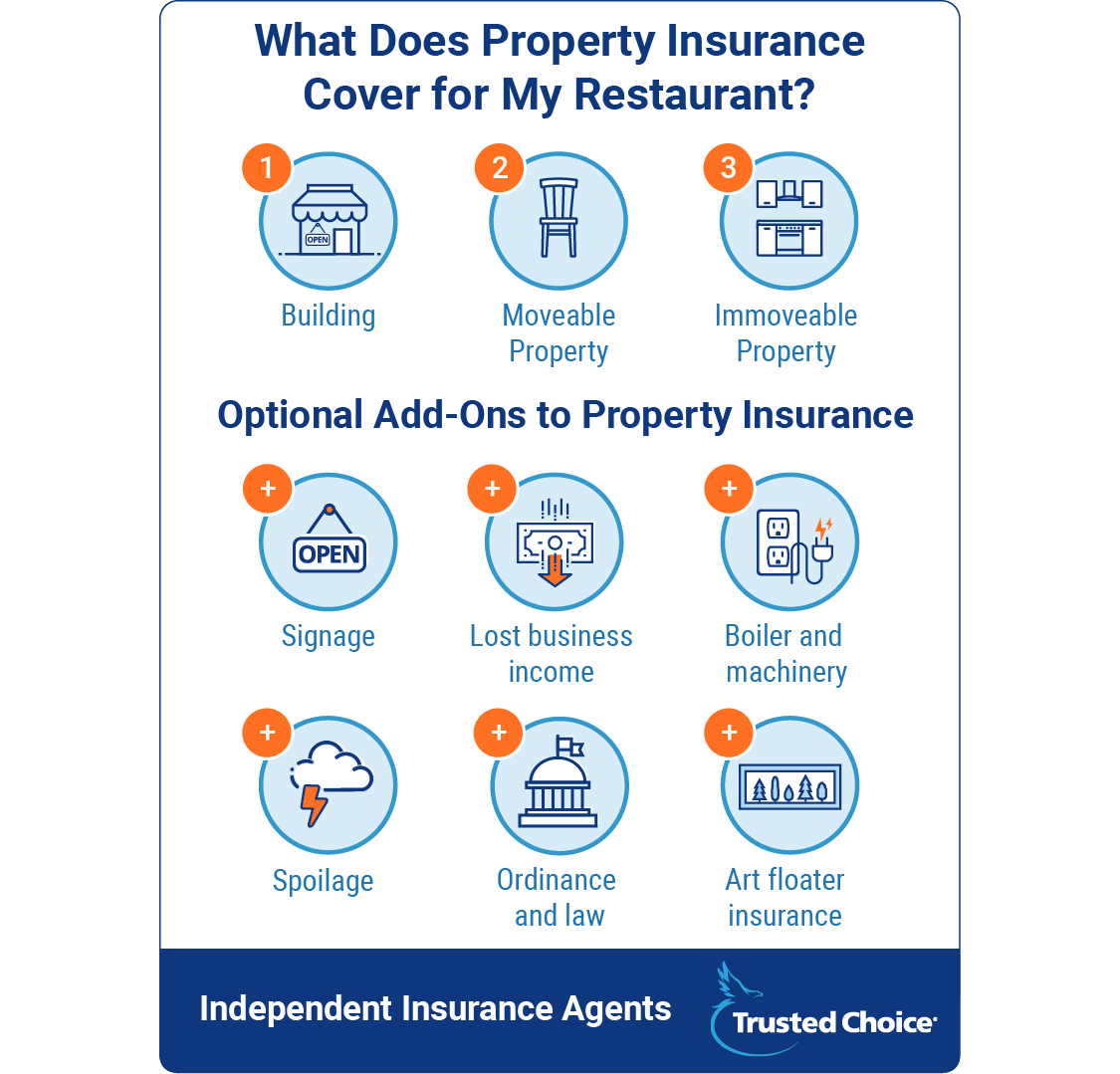

Every restaurant has property, so every restaurant has property insurance. Now there are two types of property. There’s real estate (cleverly known as real property) and there’s personal property. But be warned. General property insurance only covers movable personal property. Movable is fancy pants talk for things that aren’t physically bolted down to the restaurant. Think tables, chairs, and décor you add “for that special atmospheric touch.”

Now you’re probably wondering: What about the stuff that's bolted down? Typically, this would include a lot of kitchen equipment, and maybe a bar in the front of the house. And this is where your independent insurance agent comes in. They’ll know whether you need additional coverage for the stuff that’s bolted down.

Keep in mind that certain factors unique to your restaurant may influence the cost of coverage. The type of kitchen equipment you use could increase property coverage. The idea is that if it's dangerous (i.e., more likely to do property damage), then you're going to pay more for coverage.

Then there’s the real fancy stuff. And by fancy we mean additional policies you may or may not need. Luckily, your independent insurance agent can help you out here, too! Some of these policy options include:

- Coverage for your sign: Fun fact – restaurant signs can cost tens of thousands of dollars, if not more. If you’ve invested in a fancy sign, you should invest in additional coverage for it. This would keep you covered if someone were to run into the sign with their car, if a vandal spray-painted or destroyed the sign, or if the weather took a toll on it. This would also cover the sign in the drive-thru, if you have one!

- Lost business income: Bills keep coming and employees need to be paid even if you’re shut down because of a fire or natural disaster. Lost business income coverage means you’ll get income during the closure to keep things afloat.

- Spoilage: Nothing spoils your restaurant’s budget like spoiled food. If you have a refrigerator or freezer malfunction, spoilage coverage will pay you back for the food you lost.

- Equipment (boiler and machinery): Air conditioners, utility boxes, and other equipment breaks. When it does, it could damage wiring, plumbing, or other systems. This additional coverage takes care of that potential damage.

- Ordinance and law: If your building isn't up to snuff (i.e., current state codes), this coverage is your saving grace. It'll also kick in if you need to rebuild after some kind of damage, or if you're literally building your restaurant brick by brick from the ground up. Relevant factors include handicapped-compliant features, fire safety equipment, and emergency exits.

- Art floater insurance: It’s important to get special property appraised. If you have some long-lost artist’s last painting hanging in your hallowed halls, get it appraised. Property coverage won’t cover the appraisal value if you never had it to begin with. So if you own fancy property, get the fancy coverage. It's called an art floater policy, it covers theft or loss, and it's important.

Cover Your North Dakota Restaurant’s Liability

Liability is really just another way to say risk. And as soon as you open those doors to the public, you open the metaphorical doors to lots and lots of risk. But fear not! Your independent insurance agent is here to take care of that for you, too.

General liability insurance is something every North Dakota restaurant needs. This protects you if a customer gets sick from your food (food poisoning or otherwise) or injures themselves while in your restaurant. Think of your standard slip, trip, and fall. If you’re reading this, you probably also know that it snows in North Dakota. So if you don’t clear the parking lot or sidewalk, you’ll pay up for parking lot fiascos, too.

Then there’s alcohol. Most restaurants serve alcohol. Or maybe you brew alcohol. Perhaps you distill it. Whatever you do with it, you need a liquor liability policy. Liquor liability keeps you covered if you overserve a customer, they drive their car, and they hurt themselves or someone else. It covers bodily injury and property damage and, quite frankly, keeps your business afloat (because if you don’t have this coverage, you’ll be paying up). Liquor liability is important because your general liability policy won't cover an alcohol-related incident. And while chains have stricter serving policies and are less likely to need this coverage, your smaller restaurant will probably need it.

Communicable disease is another type of liability coverage. It isn't a suggestion that your employees wash their hands before returning to work. However, some employees might take it that way. Communicable disease coverage protects you if a customer becomes ill after dining at your restaurant.

There’s one last liability policy that’s popular with restaurants: directors and officers liability. Now, this is relevant if you’re a larger restaurant, but it could matter if you’re smaller, depending on your risk exposure. The problem this policy solves is the potential for employees, stockholders, or even a city (yes, an entire city) to sue your business for a poor business decision. There doesn’t need to be an injury or any damage, just a bad decision. This policy covers the costs of the lawsuit, which can be a whole lotta dough.

North Dakota Dram Shop Laws

Like virtually every other state with dram shop laws, North Dakota's statute creates a cause of action for injuries or death against a restaurant serving alcohol. Specifically, dram shop laws permit third parties injured by overserved customers to sue a restaurant for property damage and injuries if employees knowingly disposed, sold, bartered, or gave away alcoholic beverages to an individual under the age of 21, to an incompetent individual, or to someone who is obviously intoxicated.

The point of having a liquor liability policy is to protect your restaurant against what could be incredibly high litigation costs. Your independent agent can talk you through the policy limits. Just know that if your restaurant has anything to do with alcohol, you're going to need coverage because of dram shop laws.

Cover Your North Dakota Restaurant’s Employees

Then there are your employees. You have to follow the law, which means you have to purchase workers' compensation coverage. Workers' comp means that if an employee is injured on the job (think sharp knives, hot oil, etc.), their medical expenses, lost wages, and rehabilitation costs are covered.

An optional form of employee-related coverage is employment practices liability insurance. In normal talk, this coverage protects your restaurant if an employee decides to sue because of discrimination, sexual harassment, or a hostile work environment. Really, it’s just peace of mind knowing that if you’re sued, your restaurant and its officers are covered.

Features Can Change Coverage

Every restaurant has features that make it unique. Maybe you have a drive-thru. Maybe you don’t. Maybe you only offer carry-out. Or maybe you have a full wait staff. We could go on and on - but you get the idea, right?

We’ll let you in on a little secret: Not every feature will change your restaurant insurance needs. In fact, we’ll drop a knowledge bomb on you right now. Having a drive-thru changes very little. Sure, you need some property insurance for the pavement, but if you purchased sign coverage for your main restaurant sign, you can tack on the drive-thru sign there, too. That's literally all you need to worry about with the drive-thru.

Now, you’re smart and you can put two and two together and figure out that if you’re purely carry-out vs. a fully staffed dine-in establishment, insurance is going to change. After all, a dine-in restaurant has more employees, so workers' compensation will cost more. And if customers are hanging around, so is the risk that they’re going to slip, trip, or fall on something (meaning your general liability insurance will increase, too).

Then there’s the issue of delivery. Delivery is great, but it means liability coverage will cost more. So then you have to decide whether you want to cover your employees’ cars or purchase vehicles for employees to use. Buying vehicles is obviously more of an up-front cost. But covering your teenage driver’s old beater can cost a pretty penny. Your independent insurance agent will help you weigh the pros and cons and figure out what works best for your situation, regardless of whether the cars are vandalized or there's an accident. Oh. and if you're running a food truck, you'll need this special liability coverage, too.

How Much Does North Dakota Restaurant Insurance Cost?

If you came to this article looking for a hard and fast rule on how much your insurance is going to cost, don’t hold your breath. And while we might disappoint on this front, your independent insurance agent can take you through the process of actually pricing out your policy. We understand if you prefer your agent, no offense taken.

As a preliminary matter, there are two prices you’ll pay:

- Workers' compensation, which is priced per $100 of payroll and by risk classification (i.e., how much risk your workers are actually exposed to)

- Property and liability

On the low end, property and liability can cost $1,000 annually. Yes, that’s the price for a whole year of coverage. Now this type of pricing is realistic for your corner hotdog or ice cream stand. There aren’t many employees, there is virtually no property, and the risk is minimal to nonexistent. Sure, customers can still get sick, but that risk is pretty slim given your customer base. This also makes this kind of restaurant the safest/cheapest to start if you're looking to dip your toe in the water.

On the high end, property and liability can cost tens of thousands of dollars, or more (as in, $100,000 per year and up). The sky’s the limit. But there is still going to be a limit, don’t worry. The problem is that there are a lot of employees, a lot of customers, a lot of property, and a lot of risk. Risk costs money. But this is the type of money you'll be spending if you start something expensive and risky, like a chain restaurant.

By working with your independent insurance agent, you can cut out what you don’t need and make the coverage as affordable as possible without exposing yourself to problems.

Get Covered with an Independent Insurance Agent

Independent insurance agents know restaurant insurance in North Dakota. And when you need the basics and a little extra to reduce other risks, they’ll give you all the options and tricks you need to put together a policy that works for you.

The best part is that independent agents take out all of the guesswork and can put multiple policy options in front of your face. This means that you do none of the work, reap all the reward, and everything is broken down into plain English. No more insurance speak. With one of our independent agents, you'll know what you're signing for on the dotted line.