Life Insurance Discounts

(Let’s lower the price tag on that priceless protection)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Life insurance is a lot like a parachute: Skydiving without either is never a good idea. Not to mention it helps protect you and your loved ones if something goes wrong, too. But isn’t life insurance expensive? Answer: It doesn’t have to be. Lower your life insurance price tag with discounts and put more of your hard-earned money into living your best life.

Everything from your marital status to your quirky hobbies could save you big on life insurance premiums. Our independent insurance agents can help you find the discounts you deserve, save you some serious money, and get you covered where it matters. So let’s talk a bit more about these life insurance discounts.

But don’t forget to grab that parachute, because we’re jumping right in.

What Are Life Insurance Discounts?

When you get life insurance, you're signing up to pay premiums (usually monthly, quarterly or yearly payments) in exchange for a payout to the recipients you choose if you pass away while the policy is active.

Simply put, life insurance discounts are a super-simple way to lower those premiums. But insurance discounts aren’t like a traditional coupon, though–there are no BOGOs or rebates when it comes to insurance discounts.

It’s more like a numbers puzzle that the insurance company uses to calculate how likely you are to pass prematurely. The less likely that is, the less you’ll pay. Morbid, but true.

There are two main types of life insurance: whole and term. Whole life insurance covers you for the rest of your life as long as you continue to pay premiums.

Term life insurance covers a specific amount of time, say ten or twenty years, and is usually used to cover specific costs like a mortgage in case of your death. Many people carry both at the same time. In some cases it makes sense to choose one or the other.

Which type you get and when you get it determines how much you'll pay in premiums. Life insurance companies use their formulas to determine the unique risks you face, then distribute that risk over the duration of your policy.

That's why getting whole life insurance when you're young is typically very cheap: You'll probably be paying premiums for a long time, so your insurance company doesn't need to charge as much to break even.

On the other hand, if you're getting a term life insurance policy over a relatively short amount of time (say, ten years), and you're well past your carefree twenties, you'll have to pay a lot more in premiums.

A company's insurance formula factors in things like your age, location, health (an exam is often mandatory), job, and hobbies. The younger, healthier, and safer you are, the cheaper your life insurance will be, because your risk of death is lower. Those lower risks work like discounts.

There are, however, a few life insurance discounts that actually are more like coupons to be applied, regardless of risk. Insurance companies commonly offer discounts to veterans and teachers. Your union or professional association may also offer insurance discounts, along with social groups like AARP and certain religious organizations.

It’s important to remember that not all life insurance discounts will be spelled out in your policy, even if they’re still saving you money. You’ll probably know if you’re getting a military or veterans’ discount, but you might not realize you’re getting a discount for not going skydiving, too. It’s all part of the numbers puzzle.

Insurance companies (also called carriers) don't like to share their exact formulas with customers. It's key to their bottom line, so they consider it proprietary information. Luckily, we've got insider knowledge.

What Life Insurance Discounts Are Available?

4 Major Types of Discounts

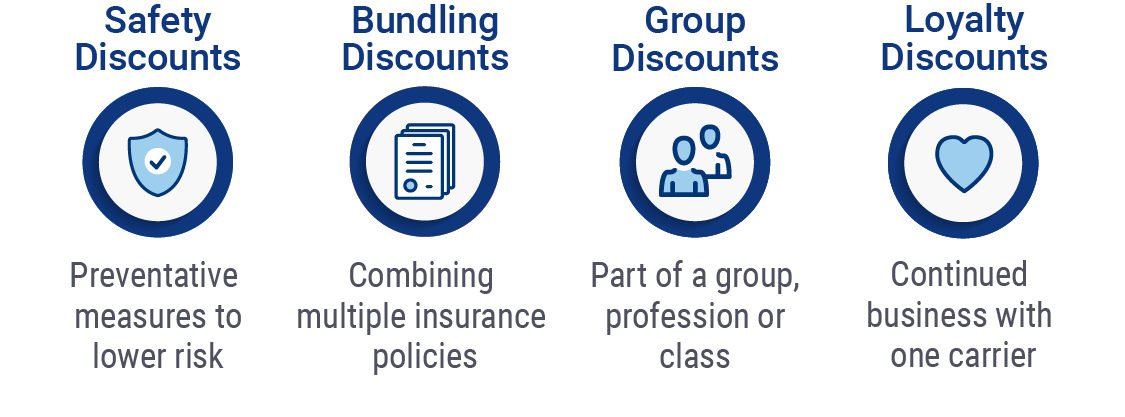

There are almost as many discounts available as there are companies to give them. But they can all be divided into four major types:

- Safety discounts: These are discounts you can get if the insurance company sees that you take good care of your bod. These include lower rates for those who don’t smoke, drink in moderation, and follow a regular exercise routine.

- Sometimes safety discounts aren’t obvious. Your life insurance costs may be lower if you’re married. That’s because insurance companies have found that married people don’t tend to die prematurely as often. It’s all a part of the big puzzle.

- Bundling discounts: These are discounts you can get if you buy multiple types of insurance with the same company. Say you need to get some car insurance along with your life insurance. Get both with the same company and they're likely to cut you a sweet little deal.

- Group discounts: These are discounts you can get if you belong to a certain association or profession. Commonly available group discounts include those for military members, teachers, and government employees. Other niche discounts include ones for farmers, clergy, and even dentists.

- If you work in a dangerous field like logging, the military, or Deadliest Catch-style Arctic crab fishing, it’s especially important for you to check with your employer and see if there are special deals you can qualify for. Otherwise you could be all caught up in much more than you bargained for.

- Loyalty discounts: These reward customers who stay with the same insurance company for a long time. You can also get a loyalty-style life insurance discount for buying a nice round number’s worth of coverage, like 250,000 or 500,000.

There are literally hundreds of factors that go into determining the cost of your life insurance premiums. Here are a few more specific examples of life insurance discounts you could qualify for:

- Smoking: If you've never smoked tobacco, you'll get a discount on life insurance. If you currently smoke, quitting can lower your rates. Smoking marijuana is currently a life insurance gray area that can raise or lower your rates (depending on if you smoke recreationally or medicinally, for example).

- Alcohol use: Abstaining or drinking in moderation is always a healthier choice and will translate into life insurance savings you’ll love.

- Exercise: Sticking to an exercise routine keeps you healthier and helps you live longer. Insurance carriers may offer their own fitness program you can enroll in, or trust you to manage things on your own.

- Hobbies: Skydiving, bull-riding, and round-the-world sailing may be fun, but they're risky. Stick to jogging or reality TV and your premiums will be much lower.

- Job: Office jobs carry less risk than dangerous industries like logging, fishing, or farming. These jobs can get you a discount on life insurance.

- Marital status: Being married helps you live longer on average, so it helps keep your premiums lower.

- Age: The biggest risk factor for death is age, since none of us live forever--yet. Buying your insurance younger will save you big on premiums, since you'll theoretically be paying them longer. (That's why buying life insurance for kids is so cheap and cost-effective.)

- Gender: Women pay cheaper life insurance premiums on average than men do. Women tend to live longer, so they're safer bets for life insurance carriers. Weird but true!

- Location: Life insurance carriers collect detailed data on the risks and benefits of different parts of the country. It'll rarely be spelled out in your policy, but living in healthier areas will save you money on premiums.

- No illnesses or genetic conditions: Any health condition that increases your risk of premature death will make you more expensive to insure.

- Healthy family history: Some insurers take family histories of heart disease, stroke and more into their calculations. Having a healthy family tree nets you discounted insurance.

- Bundling insurance: Do you need to insure a car, apartment, or home, too? (It's almost always smart to get a life insurance policy to help cover your mortgage in case you pass away before it's paid off.) Bundling these policies with the same company will probably get you a discount.

- Bundling with other financial services: Most life insurance policies also offer other financial planning and investment services. You can usually bundle these just like you would bundle multiple insurance policies.

- Group insurance: Buying life insurance through your workplace means your risks are being bundled with a bunch of other people's, which can work in your favor if you're particularly risky.

- Buying life insurance through your employer is practically a requirement if you're in the military or a super-risky profession like logging or oil drilling, since most regular companies aren't equipped to handle those risks.

- Military and veterans: If you're an active service member, you are likely to struggle to find a cost-effective policy from a civilian life insurance policy. That doesn't apply to veterans, though, who often get great insurance discounts in recognition of their service. The spouses and children of veterans and active-duty military personnel may also qualify.

- Teachers: Teacher discounts are among the most common insurance discounts out there. They may be offered through your union, employer, or just generally through a life insurance carrier.

- Paying your premiums yearly instead of monthly: Insurance companies like it when you pay up front instead of month-to-month. (More frequent payments are called "fractional premiums," as in fractions of a year.) Switching to paying once a year or every six months can significantly lower your premiums if you can afford it.

- Premium amount discounts: Buying a life insurance policy at a nice round number like 100,000, 250,000, or 500,000 can be cheaper than buying insurance near those numbers. This is about as close as a life insurance discount gets to a BOGO.

All these factors are in play whether you're buying insurance for yourself or someone else. The safety discounts will follow whoever's being insured. (Even if you're fit as a fiddle, if you're insuring an ill relative, it's not going to bring your costs down.)

How Hard Is It to Get Life Insurance Discounts?

Life insurance discounts can be frustrating to get because so many of them depend on stuff you can't control, like your age, your family history, and where you live. If you're struggling to get life insurance discounts, we recommend shooting for bundling, group, and loyalty discounts instead of stressing over safety ones.

Here are three convenient places to start looking for life insurance carriers who might offer good discounts:

- Your employer: Group insurance through your employer gets you off the hot seat. Your life insurance is getting bundled in with other people's, who may be healthier and less risky than you are. This usually lowers your rates.

- Insurance companies that friends and family use: You and your loved one could get referral perks if you decide to buy insurance at the same company. You'll also have the inside scoop on customer service.

- An independent insurance agent: Independent agents can shop around with a number of carriers instead of just one, meaning they can find you the actual best price--not just the "best price" one company offers.

Once you have a life insurance carrier or three in mind, here are four easy steps you can take to clinch the deal at a discount:

- Step 1—Pay attention to premium amount discounts: Getting $500,000 in insurance coverage can actually be cheaper than getting $400,000. That's because many life insurance carriers offer "amount discounts" at certain round numbers like 100, 250, and 500k. Be sure to ask where these benchmarks are, since rounding up can lower your premiums and offer more benefits.

- Step 2—Bundle with other financial planning services: Life insurance carriers often offer additional financial and retirement services. If you don't want to bundle your car insurance with your life insurance, you might be able to get a deal by bundling these financial services with your life insurance instead.

- Step 3—Only buy what you need: Make sure you know exactly why you're buying insurance and how much you need. Buying too much insurance or the wrong kind (whole life when you really need term, for example, or vice versa) can push up your premiums. You should have a rough idea of what expenses you'd like a payout to cover before you officially buy life insurance. An agent can help you hammer out the details.

- Step 4—Pay premiums annually instead of monthly: Many life insurance companies charge a pretty penny if you want to pay premiums monthly or quarterly. You can get the best deal by paying everything once or twice a year instead. Try setting the payments aside in a savings account every month to make this more affordable.

- Bonus round: renewal guarantees. If you're buying a term policy (one that lasts a fixed amount of time rather than for your whole life), a renewal guarantee is a slick way to avoid needing to shop for life insurance all over again when the policy is up. Just like it sounds, this guarantees that you'll be able to re-up your policy without needing to undergo another health exam or extra paperwork. Your rates will go up with age, but it's still way easier and cheaper than needing to shop all over again.

How Do I Get Life Insurance Discounts?

First, remember that you're probably already getting discounts based on stuff you don't have a lot of control over: your age, location, gender, and health. The positives might not be spelled out as discounts in your coverage, but they're still saving you money.

Because there's so much about life insurance coverage that you can't really control, the best way to get life insurance discounts is to shop smart and compare wisely.

Getting an independent insurance agent on your side early helps to narrow the field, since there are literally hundreds of companies offering life insurance, and the variety can be overwhelming. Comparison shopping between carriers is critical to saving money on premiums.

Before you get down to business, it also helps to think about why you really want life insurance. Are you a family breadwinner who wants to provide for your family if you pass away unexpectedly? Would you like to pay off a mortgage or another significant loan? Are you concerned about funeral costs? Would you like to leave an especially generous gift to charity?

Whatever your reasons, be sure to clue in your agent. They can home in on the coverage you need and trim the stuff you don't, which saves you money.

The most important number to look at while comparing life insurance is the net cost index. This number allows you to compare the cost of a policy over its lifetime to the potential payout. If you get overwhelmed while comparing policies with different terms and premiums, the net cost index will help you see how truly discounted a policy is.

Getting discounts on your life insurance doesn't have to stop when you pick a plan. Keeping your agent updated on major life events like marriage, a new house, or a job change can help you qualify for discounts you missed the first time around when your policy is up for renewal.

The Benefits of an Independent Insurance Agent

Well, now you know how discounts work. But your time is valuable, so why spend it doing all the hard work yourself? Our independent insurance agents stay on top of the industry and all the latest discounts so you don’t have to. That means they’ll help find the right coverage at the right price for you.

They’re not just there at the beginning, either. If disaster strikes, your agent will be there to help walk you through the claims process and make sure you are getting the benefits you're entitled to. Now that’s thinking ahead.

III.org