Annuity Loans

(What to know before you take cash from an annuity.)

Annuities can help you save for retirement and even offer special features and tax benefits. But where there are tax benefits, there are usually strings and a lot of rules attached. One way to get access to your annuity is with a loan. But borrowing from your deferred annuity, or using it for collateral, can have some very unhappy tax consequences.

Before you borrow from an annuity, it's best to understand how they work and to reach out to an independent insurance agent to see if borrowing from your annuity is a smart financial choice for you. They’ll help guide you through all your options, weigh the good and the bad, and even see you through it all from start to signature.

What Is an Annuity Loan?

You get an annuity when you make a lump-sum payment to an insurance company in return for a guaranteed cash flow provided through installments from the company. Essentially, you're making a loan to the insurance company. You give them a large amount of money and they pay you back over time in installments with interest. There are four common types of annuity loans:

- Immediate annuity loans are also known as retirement annuities and begin payment as soon as the lump-sum purchase payment is made.

- Fixed annuity loans are annuities that pay a fixed amount for the life of the annuity regardless of how well the annuity’s investments perform.

- Deferred annuity loans are the opposite of immediate annuities. They begin payments at some future time that you select, such as at a certain age.

- Variable annuity loans make higher or lower payments depending on how well the annuity’s investments perform. This is the only type of annuity where loss of principal is possible; however, options can be added to protect you from losses.

When you purchase an annuity, any earnings that you make on your investment are not taxed until they're paid out to you. However, there are qualified and non-qualified annuity loans, and this will determine if and when the taxes on your annuity are due.

- Non-qualified annuities: Annuities that are purchased with money for which taxes have already been paid.

- Qualified annuities: Annuities that are purchased with pre-tax money.

Why Take a Loan from Your Annuity?

There are lots of reasons to borrow money, of course. Some short-term reasons are temporary cash flow difficulties in real estate transactions, college tuition, and other transactions.

Another might be access to emergency funds for unanticipated expenses. Long-term reasons might be for large purchases or expenditures, mortgages, automobiles, college tuition, home improvement, etc.

Whatever the reason, people borrow money because they want cash.

What Happens When You Borrow from a Non-Qualified Annuity?

Non-qualified annuities are not part of a pension plan or an IRA. They're bought individually with after-tax dollars. Non-qualified annuities usually do not have loan provisions.

They can, however, be used as collateral for a loan from a bank or any other third party. Non-qualified fixed annuity loans and variable annuity loans are treated the same way.

When a non-qualified annuity is used as collateral, the IRS considers the loan to be a withdrawal, or non-periodic distribution, from the annuity.

Here's the problem: Non-periodic distributions from annuities are taxable up to the amount of gains that have been accumulated. The taxes are paid at ordinary income rates. If you're under the age of 59-1/2, you'll also pay a 10% penalty tax.

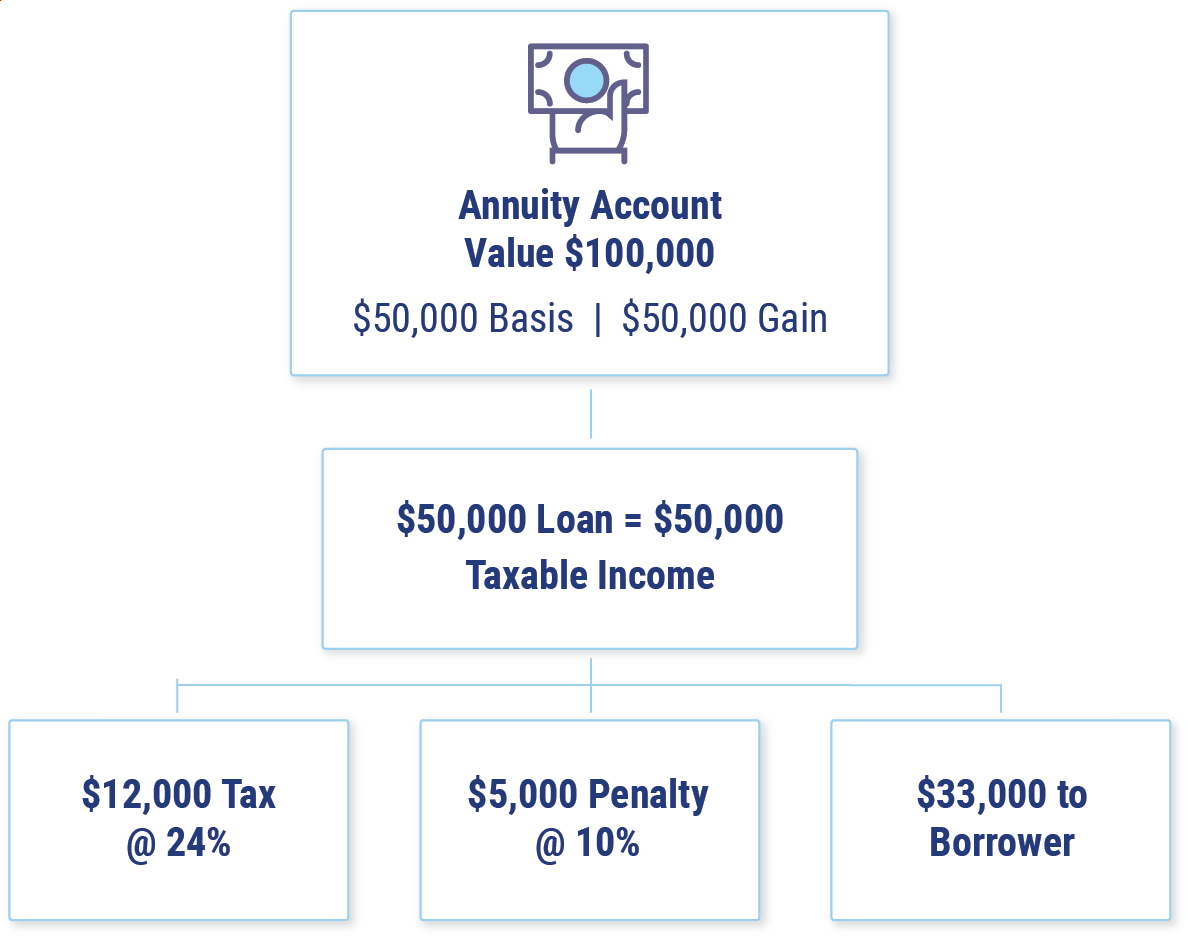

Here's what can happen if you take a loan using a non-qualified deferred annuity as collateral and you are under 59-1/2.

Assuming you were in a 24% tax bracket, only 66% of the loan was available. 34% went to Uncle Sam. Adding insult to injury, not only did you pay taxes on the loan, but now you will pay interest on the taxes to the lender.

Annuity Loans and Retirement Plans: What Happens When You Borrow from a Qualified Annuity?

Qualified annuities are bought with pre-tax dollars. They're part of a pension plan or an IRA, and loans are not permitted in an IRA for any reason. Annuities that are part of an IRA cannot be used as collateral.

Loans are available from deferred annuities that are part of a pension if the plan allows it. Loans can be taken without penalty or tax consequences if:

- The proceeds are paid back within 5 years.

- The loan is $50,000 or 50% of the vested account, whichever is less.

- The proceeds are used for a first-time home purchase.

Annuities that are part of a pension plan often have loan provisions. 403(b) plans, which are savings plans for teachers and other public employees, often have annuities available as an investment choice. Annuities in 403(b) plans typically have loan provisions.

Qualified fixed and variable annuity loans are treated the same way.

A loan from your qualified annuity may have some unintended consequences even if you follow the rules. Money contributed to qualified plans is not included in your taxable income. The tax is paid when you take the money out.

In a nutshell, annuity loans and retirement don't go well together. When you take a loan from a qualified retirement plan, it's repaid with money that's included in your taxable income. When that money is withdrawn from the plan, it's taxable. This means you'll be paying tax twice on the same money. Not to mention interest on the loan.

Should You Take Loans from Your Annuity?

Annuities are retirement products. By design, they are long-term investments. Using your non-qualified annuity as collateral for a loan is potentially very expensive. In addition to interest charges, the loan can result in unexpected taxes and penalties.

If you need cash, borrowing from your qualified annuity can also be very expensive because you will be paying taxes twice on the same money. Deferred annuity loans in particular, whether qualified or non-qualified, are not a good choice when it comes to borrowing money. Before you borrow from an annuity, be sure to speak to your professional tax adviser.

Why Choose an Independent Insurance Agent?

Annuities are complicated, and searching through options can be confusing, time-consuming, and frustrating. An independent insurance agent's role is to simplify the process.

They will make sure you get the right coverage that meets your unique needs and will break down all the jargon so that you understand exactly what you're getting.

Advisor’s guide to annuities John Olsen

IRS Pub 575

IRS Pub 410

IRC 72

irs.gov retirement topics plan loans