Variable Annuities: Pros & Cons

(The Good, The Bad, and of course ... The Ugly)

Neel Lane is an independent contract paralegal who specializes in Medicaid and VA benefits. He helps people access and maximize the benefits that they're entitled to. He has over 30 years of experience in this area.

Nobody ever said variable annuities were easy to understand, because the truth is, they’re not. Variable annuities are a financial tool designed for a job, but they’re a complicated mix of insurance and investments. Whether they are good or bad depends on what exactly you want them to do.

Independent insurance agents are absolute experts when it comes to confusing puzzles like these, and their job is to simplify the process. Because you don’t want to be left alone to do it all by yourself, it’ll just be a mess.

They’ll help guide you through all your options, weigh the good and the bad, and even see you through it all from start to signature. Now that’s a whole lot simpler.

First Things First - What are Variable Annuities

Annuities are one of many different types of policies issued by insurance companies. With an annuity, the policyholder (or annuitant) receives regular guaranteed income for life, or an agreed upon number of years. Your annuity contract begins by making either a single payment or a series of payments.

There are actually a number of different types of annuities that all work differently, but the most popular include:

- Deferred variable annuities accumulate money for a period of time before the policy pays income.

- Immediate variable annuities pay income right away.

- Deferred variable annuities accumulate money in investments selected by the owner called subaccounts. Like mutual funds or other investments, the value of the subaccounts is based on market performance. They’re not guaranteed.

- Indexed variable annuities offer partial protection from market losses and accumulate money by tracking a market index, like the S&P 500.

- Qualified variable annuities are part of a pension plan or IRA. They are purchased with before-tax dollars.

- Nonqualified annuities are personally owned and paid for with after-tax dollars.

- Group variable annuities were created by life insurance companies as a vehicle to administer 401k plans. Group annuities are often used for small- and medium-sized plans.

The Pros of Variable Annuities

If your goals align with variable annuities, the pros are plentiful. But they're not always for everyone. Among the many benefits, you can expect:

- Variable annuities accumulate money on a tax-deferred basis: The growth in the subaccount investments, capital gains, and dividends aren’t taxed until money is taken out of the variable annuity.

- Money can be transferred between subaccounts without any tax consequences: For investors who regularly rebalance their portfolios, tax-free transfers are an important feature. Here’s why. When investors decide to make changes they usually have to sell something to buy something else. If there is a gain when they sell, taxes are due. In a variable annuity, investors can make those transfers without paying taxes.

- Nonqualified variable annuities have no contribution limits: Unlike IRAs and qualified plans, there are no contribution limits to nonqualified variable annuities. Investors who are contributing the maximum to their retirement plans can use a nonqualified variable annuity as a supplement. This feature is really valuable to retirement savers who don’t have a company plan. The limits on IRA and Roth contributions are $7,000 and $6,000. For higher income savers, the benefits are reduced or eliminated.

- Variable annuities provide guaranteed income: Annuities protect you from outliving your income. Income received under an annuity option is partially taxable.

- Variable annuities have features called living benefits that offer a guaranteed minimum income regardless of investment performance. This feature protects retirement savings from drops in the market. It’s a valuable feature for investors approaching retirement.

- Variable annuities have death benefits to protect beneficiaries: If you die before receiving guaranteed income, your beneficiary will receive a death benefit. Usually the death benefit is the greater of your account value and the amount of your purchase payments. Variable annuities also have optional enhanced death benefit riders for legacy planning.

- Variable annuities are protected from creditors: Most states offer variable annuities some form of creditor protection. In some cases, unlimited.

The Cons of Variable Annuities

Where there are pros, there are often cons too. But many of the downs that can come with variable annuities may not affect you. You can, however, expect:

- Variable annuities can be expensive: Depending on the insurance company and features selected the fees and expenses can be upwards of 3%. Variable annuities have fees for Mortality and Expense, Investment Management, and optional riders. Some variable annuities have low cost options.

- Variable annuities are not as liquid as other investments: Most variable annuities have surrender penalties for the first four to seven years of the contract. Surrender penalties apply to withdrawals in excess of 10% of the account value

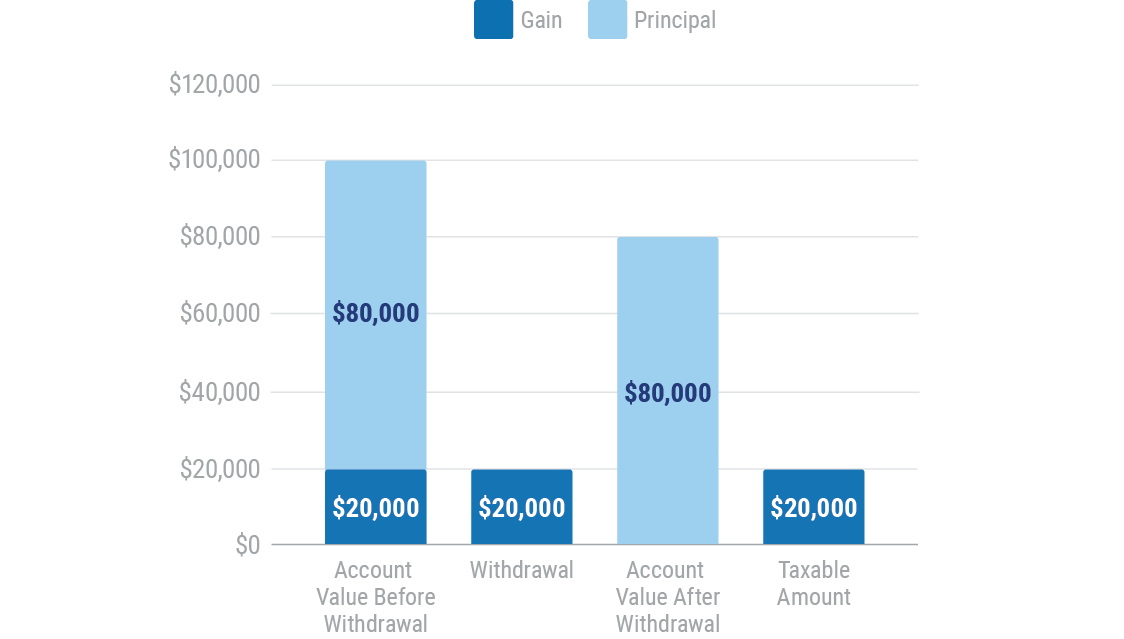

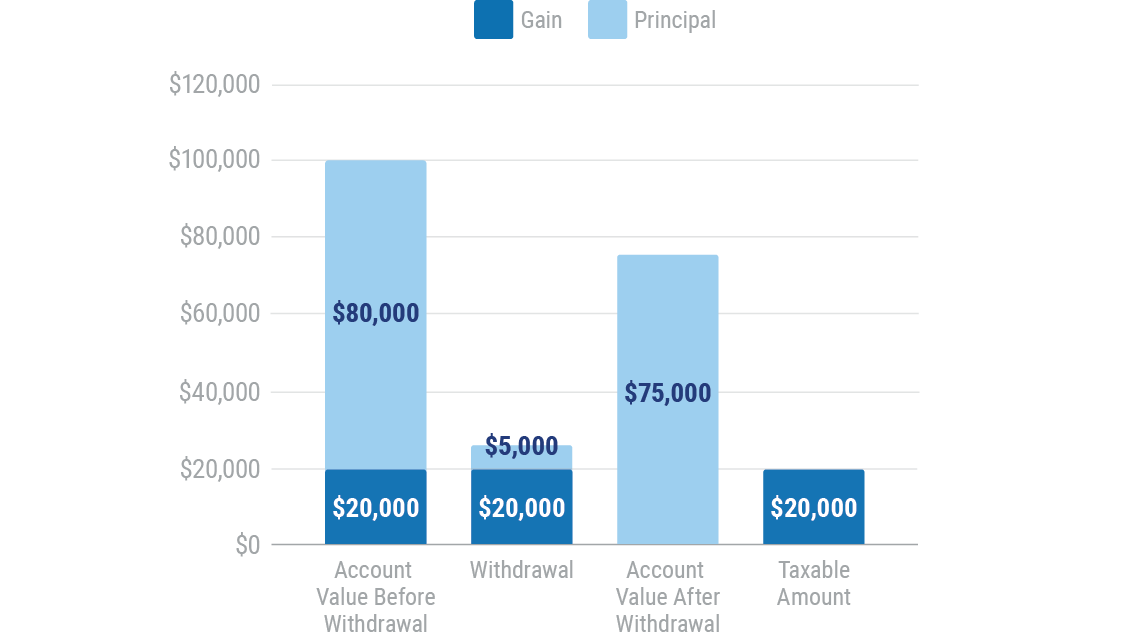

- Gains are taxed first on withdrawals: Distributions from variable annuities that are not regular payments are taxed at ordinary income rates until there are no gains left in the contract. Loans from nonqualified annuities are treated as non-regular distributions and taxed the same way. This means that when money is taken out of a variable annuity, it’s 100% taxable until all of the gain is withdrawn. The charts below show how withdrawals are taxed.

100% of $20,000 withdrawal taxed as gain at ordinary rates

80% of $25,000 withdrawal taxed as gain at ordinary rates

- Variable annuity gains are taxed at ordinary rates: Variable annuities are not eligible for the lower long-term capital gains tax rate.

- Indexed Variable Annuities limit growth: In exchange for the downside protection, indexed variable annuity accounts have limits on the growth potential of the account.

- Guarantees are based on the insurance company’s ability to pay claims: The primary rating services that cover insurance companies are A.M. Best, Moody’s, Standard & Poor, and Fitch.

The rating each service assigns reflects their opinion on the insurance company's ability to pay claims. The chart below summarizes the ratings from each service.

| Highest Ability to Meet Obligations |

Medium Ability to Meet Obligations |

Lowest Ability to Meet Obligations |

|

| A.M. Best | A++ to A- | B++ to B- | C++ to C- |

| Moody’s | Aaa to Aa | A to Baa | Ba to Caa |

| S&P | AAA to A | BBB to B | CCC to C |

| Fitch | AAA to AA- | A+ to BBB- | BB+ to CC |

Is A Variable Annuity Right For Me?

Variable annuities are financial tools. Whether are not they are right for you depends on the job you want them to do. Here are some considerations:

- Tax-deferred growth is a major benefit of annuities. Is tax control important to you? Can you benefit from tax-deferred growth?

- Tax-free transfers between subaccounts are for investors who regularly rebalance their portfolios. Would you take advantage of this feature?

- What type of investor are you? Are you willing to take on risk? Or do you like to play things super safe?

- Variable annuities have surrender and tax penalties. Do you have adequate resources for emergencies and other short-term needs?

- Variable annuities can guarantee an income for life. Do you want a fixed guaranteed income instead of income that may benefit from market returns?

Really the best thing to do is to talk with an independent insurance agent. An agent can listen to your situation, help realize your goals, and decide if a variable annuity is right for you.

What's So Great About an Independent Insurance Agent?

Variable annuities are complex, and searching through options can be confusing, time-consuming, and frustrating. An independent insurance agent's role is to simplify the process.

Variable annuities can be an important part of your retirement plan. While they have many features and benefits, they aren't always right for everyone. Talk to your independent insurance agent. They can help you decide if a variable annuity is right for you

The advisor’s guide to annuities, John Olsen

IRS Pub 575

IRS Pub 410

IRC 72

NAIC Buyers Guide

SEC Variable Annuities

Finra Variable Annuities

The American College of Trust and Estate Counsel State Survey of Asset Protection Techniques