Colorado Life Insurance

Find the right life insurance policy for you.

Although it’s not as much fun as taking your family fishing at Spinney Mountain State Park or skiing in Vail, purchasing life insurance is one of the best things you can do for your loved ones. It helps to ensure that your family will have financial stability after you’re gone. But how do you know which policy is best for you?

When you work with an independent insurance professional, you will have access to a reliable guide who can help you find a competitively priced policy that is most suitable for your particular situation. There are more than 250 independent insurance agents in Colorado. Find an insurance agent near you to learn more about your various life insurance options.

Why Do Colorado Residents Need Life Insurance?

Life insurance isn’t required by law like car insurance, but that doesn’t mean it isn’t a wise purchase for most consumers. Whether a life insurance policy is right for you depends largely on your personal and financial situation. The average life expectancy in Colorado is 80.0 years, and most people will live to a ripe old age. Every now and then, however, life throws us a curveball. Whether it’s due to a sudden disease or an accident on the road, lives are sometimes cut short unexpectedly.

DID YOU KNOW?

When you have life insurance, you don't need to worry that your death may cause undue financial hardship for your family.

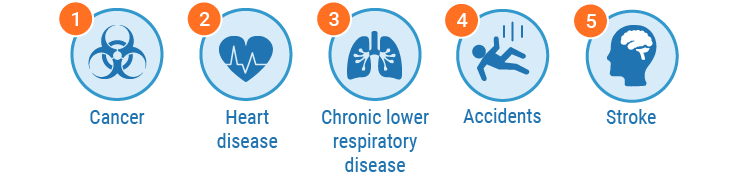

The Most Common Causes of Death in Colorado

Cancer is the leading cause of death in Colorado. It can leave behind a large financial burden, but a small life insurance policy can cover your end-of-life expenses, such as funeral costs, while a larger policy can also provide a financial legacy for your children for years to come. Life insurance is the best way to ensure that your dependents will not be left in dire financial straits if you are no longer there to provide for them.

Can I Get Life Insurance Through My Work?

Many employers in Colorado offer life insurance as part of their employee benefits package. As an employee, you may have the option to raise your coverage levels every year or so. If you have a family that depends on your income, you may feel that this coverage is sufficient and that an extra policy is not necessary.

However, if you decide to take a new job with another company, or if you get laid off following a corporate merger, or if you get sick of your boss and quit, the life insurance coverage doesn’t go with you. If you manage to stay with the company until you retire, the coverage still ends when you stop working. It is, therefore, a good idea to purchase additional coverage outside of what is offered by your job.

How Much Does Life Insurance Cost in Colorado?

The cost of life insurance varies from person to person. Factors that can influence costs include:

- Your age: This plays a significant role in determining costs. By starting a policy while you are still young and healthy, you can lock in the best rates.

- Your personal health history: Insurance companies will typically ask questions about your health as well as health issues affecting members of your immediate family.

- Whether you use tobacco products: Smokers pay significantly higher rates for coverage.

- The amount of coverage you are purchasing: Obviously, a $10,000 life insurance policy will cost far less than a $1 million policy.

- The type of policy you are purchasing: Term life, whole life, and universal life insurance have different costs. We will discuss more about these coverage types below.

What Is Term Life Insurance?

Term life insurance will cover you only for a designated period, ranging anywhere from five to thirty years. It is the most affordable way to get a large amount of coverage. A 30-year term policy can provide coverage for the length of your mortgage and until your children are grown and self-sufficient.

- Pros: This is the least expensive option. It enables you to buy a large amount of coverage for a low price.

- Cons: At the end of your term, you are no longer covered. At that time, it may be difficult to purchase another policy, particularly if you have contracted a life-threatening disease.

What Is Whole Life Insurance?

Unlike term life, whole life insurance does not expire. This coverage lasts for your entire life or at least until age 100. Although this policy costs more, it offers an investment component and tax-deferred status, so it might be worth the higher price. These policies are best if you begin them at a young age so you can maximize your benefits and lock in the best rates.

- Pros: Your tax-deferred premiums fund your policy and also build cash value. You can also tap into this money in form of an interest-free loan at any time if your financial situation warrants doing so.

- Cons: This coverage comes with a higher price tag. If you fail to pay your premium on time, the policy may be terminated.

What Is Universal Life Insurance?

Universal life insurance is similar to whole life in that it does not have a set term limit. This coverage is more flexible, because you can adjust your coverage amount, and you can use your accumulated cash value to pay your premium if you are unable to afford it in a given month. Also, because it pays a varying interest rate on your accumulated cash value, you have the potential to earn more interest than if you have a whole life policy.

- Pros: Flexibility in premium payments and coverage amounts. Has a cash value that you can tap into if needed. Policy does not expire.

- Cons: These policies cost much more than term policies.

Which Policy Type Is Right for Me?

For many people, the most difficult decision when it comes to purchasing life insurance is which type of coverage to buy. As seen above, there are pros and cons to each type of coverage. Often, a financial advisor can advise you about which is best for your current financial situation. An independent insurance agent can answer your life insurance questions and help you review quotes for each type of coverage so that you can have all the facts before making a decision.

How to Find the Best Colorado Life Insurance Policy

A local independent insurance agent can help you find the best life insurance policy to meet your coverage needs. These agents can work with multiple providers to offer you quotes for coverage, so you can choose the policy that offers you the best value for your money.

Contact one of the many independent insurance agents in Colorado to get started.