Idaho Restaurant Insurance

For when spuds are duds and other things go wrong.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When most people think of Idaho, they think of potatoes. And while not every restaurant is serving up potato dishes by the dozen, every restaurant needs restaurant insurance coverage. This means every restaurant owner needs an independent insurance agent to guide the way toward comprehensive coverage, too. Independent insurance agents are invaluable resources to navigate the risks and other trials of insurance coverage for your Idaho restaurant.

Risks in Restaurant Insurance in Idaho

What each restaurant needs will differ. However, the same factors will play a role in determining what your Idaho restaurant requires, including:

- The food you serve

- How you prepare the food

- Your building

- Kitchen equipment

- Personal property, including furniture, paintings, and more

- Special property, including a sign or items of value

- Staff (or lack thereof)

These factors will all affect what coverage you need and how much it’ll cost. But they aren’t for you to worry about: The underwriter will take care of everything when they come to assess your Idaho restaurant. Then there's your independent insurance agent, ready and able to serve as your guru to show you the way. Let's start at the top.

You Need Three Basic Types of Insurance Coverage for Your Idaho Restaurant

No matter the restaurant you run, the food you serve, or any of the other factors, you’re going to need three basic types of insurance coverage:

- Property

- Liability

- Employee

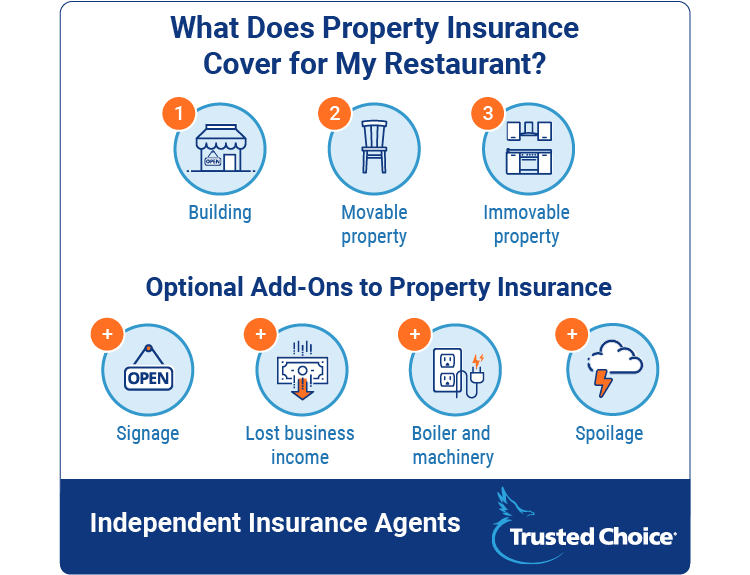

What Does Property Insurance Cover for My Idaho Restaurant?

Property insurance covers loss related to your building or personal property in the building. This means that if there’s a fire, flood, or some other natural disaster, your property coverage will pay you the replacement value for:

- The building

- Personal property in the building that you can move (i.e., anything that isn’t bolted down or otherwise attached to the building)

This leads us to the next point: Almost every restaurant has property that is affixed to the building itself. Typically, this is kitchen equipment, but could also include a bar or other built-in furniture. As you already know, this equipment and furniture are expensive, too. When you talk to an independent insurance agent about your property insurance coverage, you can discuss whether you’ll need additional coverage to account for this immovable property.

The building, movable property, and immovable property are the three basic types of property covered under property insurance. But you probably have other property, too. And, as you can imagine, each costs more to insure, but its worth it from a cost-benefit analysis. Consider the following:

- Your sign: Restaurant signs are expensive, some costing upwards of $100,000. If you have a basic property policy, the sign won’t be included, so you may want to purchase additional coverage for it. This may apply to a drive-through sign, too.

- Lost business income: If your restaurant is temporarily closed because of a covered loss – whether it’s a kitchen fire, weather-related damage, or something else – lost business income coverage means you get money while the restaurant is closed. This way, you can continue paying employees and other bills while you’re closed. You may even need this insurance if you need a loan from a bank.

- Boiler and machinery coverage (equipment): Equipment breakdowns can cause physical damage. This might be electrical or related to HVAC equipment. This doesn’t cover the cost of the repair itself, but any damage caused by it.

- Spoilage: Restaurants have food, and when you lose power or a freezer stops working, food goes bad. Spoilage coverage will pay you for the cost of the food you lose.

What Does Commercial General Liability Insurance Cover for My Idaho Restaurant?

Commercial general liability insurance covers basic issues dealing with your restaurant’s responsibility for something that happens to a customer while they’re at your location. This typically falls into one of two scenarios:

- A customer has an accident while at your restaurant

- A customer becomes ill/has a problem because of the food you serve

Generally speaking, this means that if a customer slips and falls on a wet floor, you’re covered. Or if you serve food that causes illness, that’s covered. And because it snows in Idaho, it would cover a trip or slip in the parking lot when conditions get bad. General commercial liability insurance is just that – it’s general. There are special types of liability coverage for:

- Liquor

- Directors and officers liability

Liquor liability insurance is something you need if you brew, distill, or sell alcohol in any capacity. This way, if a patron is injured or gets into an accident, there is coverage for any:

- Property damage

- Bodily injury

Directors and officers liability is another specialty liability coverage. Coverage isn’t triggered when there is bodily injury or damage but applies when stockholders, a city, or even a group of employees sue the company’s board. Generally, the lawsuit is based on a poor corporate decision. This is highly specialized coverage, and an independent insurance agent will be able to assess whether it’s insurance your Idaho restaurant should have.

Generally speaking, commercial liability insurance is a policy with a $1 million limit. If you opt for liquor liability coverage, this is another policy with a $1 million limit as standard coverage. However, if you serve or deal with a lot of alcohol, you may want to increase coverage to up to $5 million.

What Does Employee Insurance Cover for My Idaho Restaurant?

When you hear “employee insurance,” your mind probably immediately goes to workers' compensation. However, there’s also something called employment practices liability insurance. This is additional coverage that can give you peace of mind if an employee ever brings a lawsuit against your company. Workers' compensation is required by law if you’re operating a restaurant in Idaho. If an employee is injured on the job, it will cover expenses for:

- Medical care

- Rehabilitation

- Lost wages

A less common, but still often used, type of employee insurance is employment practices liability insurance. This type of coverage protects your restaurant from the cost of litigation, which can sometimes drive a restaurant out of business! Typically, it kicks in if an employee sues because of:

- Sexual harassment

- Workplace discrimination

- Bad behavior

- Hostile work environment

Employee practices liability insurance pays for the business if it’s sued and for the officers of the business. This provides broad protection and ensures that your business can stay in operation following a suit.

Restaurant Features and Set-Up Can Affect Insurance Needs for Idaho Restaurants, Too

Staff, or no staff? Drive-through, or no drive-through? These might seem like basic business decisions, but they have other implications, too. Some features could even increase costs just because your underwriter is biased. Here are some features and how they may affect insurance coverage and costs:

- Buffets: Underwriters typically don’t like buffets. Food is out and exposed to the public, which increases risks (and generally increases costs as a result).

- Drive-throughs: Surprisingly, this doesn’t affect insurance coverage. If you want that drive-through window, the most you’ll have to worry about is configuring the traffic flow.

- Wait staff: If you have a sit-down restaurant with a wait staff, you’ll have more employees than if you are a carry-out restaurant or a restaurant that has customers retrieve their food from the counter. This means more workers' compensation insurance.

- Carry-out only: The opposite is true if you have a carry-out restaurant. You’ll need fewer employees, and save money on workers' compensation coverage.

- Delivery: If you deliver, it will cost less to purchase company cars than to extend liability coverage to your employees’ cars. After all, the condition of your employees’ cars may not be the greatest. An underwriter will write you a better policy if you invest in vehicles, even if it’s just a few.

Thinking about the unique features of your restaurant before talking to an independent insurance agent will help your agent better assess the risks and costs of your future policy. More importantly, it’ll give you a better idea of what you will pay to cover your Idaho restaurant.

How Your Idaho Location Changes Your Insurance Coverage

All but one state require the three types of insurance coverage we discussed above. However, being in Idaho will mean your restaurant might serve different food or prepare food in a different way than if you were located in another state. Idaho restaurants are likely to experience the following problems:

- Frozen food: Idaho isn’t on the coast, meaning restaurants may serve more frozen food. This will affect spoilage coverage, since a freezer breakdown could cause you to lose most if not all of your stored food.

- Deep frying: Idaho has a lot of deep-fried foods, too! If there’s a lot of hot oil in the kitchen, your workers' compensation coverage will increase (because there is more risk for workers).

- Seafood: Idaho isn’t on the coast, but it’s close to the coast. If you’re flying seafood in to your restaurant, especially if you serve it raw, underwriters will be concerned about the freshness of your food and how you prepare it.

The Idaho-specific issues and considerations that could cause your coverage costs to increase will be unique to your restaurant. However, these are a few of the common issues you should keep in mind.

How Much Will It Cost to Insure My Idaho Restaurant?

Insuring your restaurant will be broken up in a few different ways. This is because you’ll pay for:

- Property and liability insurance together

- Workers' compensation insurance

Workers' compensation insurance is calculated by payroll and risk. Premium is based on payroll (per $100) and how your employees are classified (according to how risky their jobs are). This is all the information that your underwriter will have and provide in greater detail after looking at the specific facts about your restaurant.

DID YOU KNOW?

Property and liability insurance costs can be at either end of two extremes depending on considerations like the size of your operation, how you prepare food, and all of the other factors we’ve discussed above.

That being said, on the low end, you might only pay $1,000 to $1,500 annually. This is a realistic expectation if you’re running a corner taco or hot dog stand. There are few major concerns, few employees, and little probability that there will be a major catastrophe.

On the high end, the annual cost of insurance can be very expensive. And by high, we mean hundreds of thousands of dollars annually. This will revolve around things like whether you have multiple locations. At the high end, you should get unique property appraised as well. Otherwise, you may not get paid what a painting is truly worth if you feature artwork in your restaurant. Talking to your independent insurance agent is the best way to navigate these sensitive issues.

An Independent Insurance Agent Is Your Best Resource for Your Idaho Restaurant Insurance

As a restaurant owner in Idaho, the bare minimum insurance coverage must include:

- Property

- General commercial liability

- Employee insurance

More likely than not, you’ll need to purchase some specialty policies, too. And when that’s a concern, the best thing you can do is talk to your independent insurance agents. They will have the resources, options, and other necessities at the ready to ensure that your restaurant isn’t just covered, but you’re in the best position possible should something happen.