What Does Work Comp Cover?

(And more importantly, how do you get it?)

You may be wondering what’s in a workers' compensation insurance policy? It's a good question which has a number of answers. So whether you’re an employer, independent contractor, or employee, read on.

Your independent insurance agent will be able to find you the best coverage options and lowest premiums because they work with multiple carriers. Your agent will have all the specifics as they pertain to you and your business endeavors. But for now, workers’ compensation insurance is the topic of choice and going over it is the action.

What Is Workers’ Compensation Insurance?

First, knowing what workers’ compensation insurance is will help. It is a policy taken out by an employer or independent contractor to pay for medical expenses, mental health expenses and illnesses that happen on the job or as a result of doing your job.

It will also pay for wages of said injured employees usually up to two-thirds during the time of recovery. All in all, it's crucial for anyone with employees or who is self-employed and needs to cover work-related injuries and the expenses that come with it.

But What Does Workers' Compensation Insurance Cover?

So you are looking to buy yourself a workers' compensation policy. Well before you do, it's important to know what you are covering and the limits that a policy typically provides.

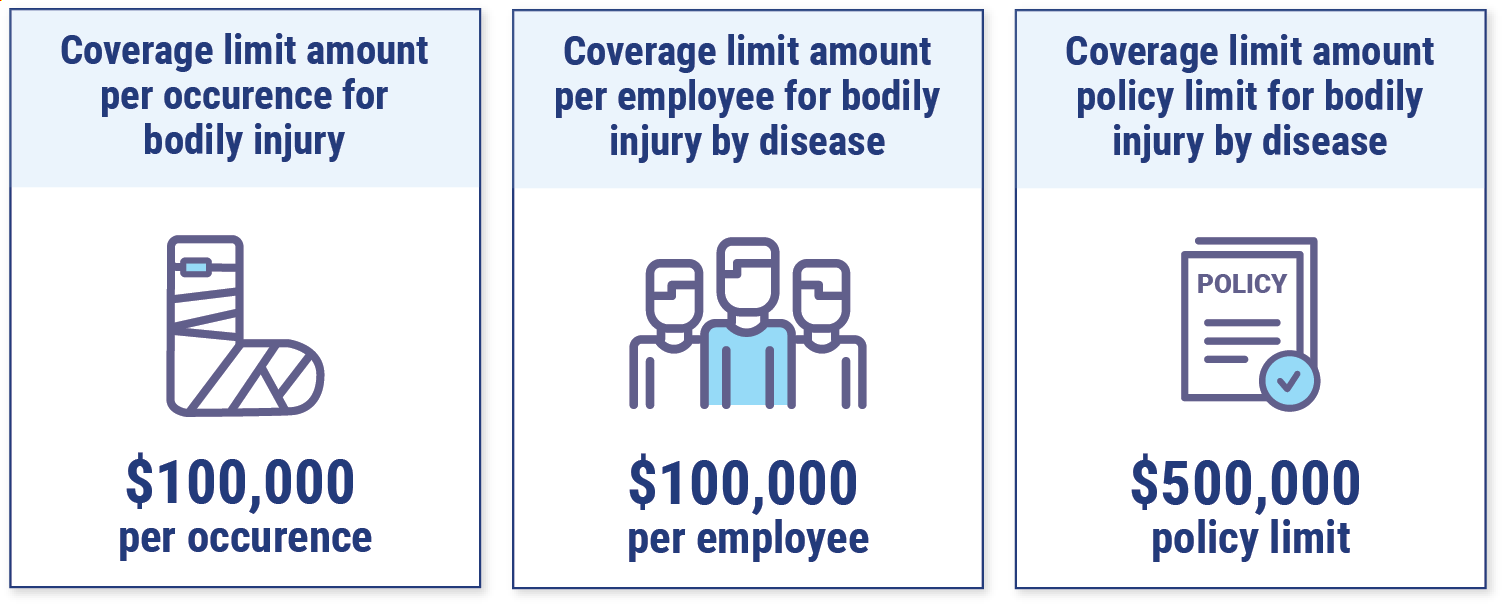

The basics are like this for a workers' compensation policy:

- Coverage limit amount per occurrence for bodily injury

- Coverage limit amount per employee for bodily injury by disease

- Coverage limit amount policy limit for bodily injury by disease

Put it all together and it looks something like this: $100,000 per occurrence/$100,000 per employee/$500,000 policy limit

The $100,000/$100,000/$500,000 are the bare minimum basic statutory limits that are typically required by law for every employer or independent contractor to carry.

But what does that mean exactly? Breaking it down into a story is always best.

Workers' Compensation Insurance Coverage Scenario:

You have a workers' compensation policy in place and you chose the basic, minimum limits of $100,000 per occurrence/$100,000 per employee/$500,000 policy limit. Your employee, named Employee A, slipped and fell at work and broke their tailbone on the hard floor of the factory. The doctor does a full examination of "A" and finds some problems not only with the tailbone, but also with a compromised respiratory system. After closer examination, the doctor determines that "A" has a disease in the lungs that could have only been caused by a chemical used at your factory.

Now instead of just one workers' compensation claim, you have two. One to cover the broken tailbone and the other to cover the disease. "A" will need $50,000 to cover medical expenses for tailbone surgery and $700,000 to cover treatment for lung disease caused by working conditions at your factory.

Your $100,000 per occurrence for bodily injury coverage will be enough to cover the $50,000 tailbone surgery. However, you only have $100,000 per employee for bodily injury arising from disease, so you are $600,000 short in coverage for medical expenses due for disease treatment for "A".

You may be thinking, but what about the $500,000 policy limit for bodily injury by disease. Can't you use that? The answer no, that limit is the total for the policy term which is usually one year. What that means is you have $500,000 in coverage for bodily injury by disease max, which is not $500,000 per employee. Each individual employee only gets $100,000 per claim. Now if you have multiple claims in a policy term (usually 1 year) then you would have up to $100,000 to give per employee and $500,000 total coverage.

If it's not quite making sense to you yet, don't worry. Your independent insurance agent can help drill down the details as they pertain to you.

What Does Your State Have to Say?

Workers' compensation insurance is mandatory in most states, with the exception of a few that have their own state-funded workers' compensation insurance. Also, most states have what's called a workers' compensation pool. It's where you pool your funds with other state residents and the state finds you a much higher priced, usually lesser coverage insurance policy.

Typically, if you are a new business and need workers' compensation coverage but can't get it from your standard carriers, you can get it from the state workers' compensation pool. It's kind of your last resort, but it's there if and when you need it.

What Does Workers' Compensation Insurance Cost?

Price is a big factor when you're looking for coverage, as it should be. But the most important should be finding the best policy that will cover you when you need it most. Costs vary from industry to industry, from state to state, from carrier to carrier, and from claims history to claims history. It's nearly impossible to know exactly how much you will spend on workers' compensation insurance. And unless you can predict the future, it's best left up to the experts.

Your independent insurance agent can undoubtedly find you the best price with sufficient coverage, making sure you are prepared for all that business throws at you.

What about Workers' Compensation Claims?

Claims are what a good workers' compensation carrier thrives at and is what insurance is all about, making sure you are protected and having coverage for claims when they arrive (and they will arrive). Filing a workers' compensation claim is as easy as a phone call to your independent insurance agent.

Easy Steps 1-2-3:

1.) Call your independent insurance agent within 24 hours of the incident.

2.) Speak with an insurance adjuster about specifics within 24 to 48 hours after the claim is called in.

3.) Sit back and let your agent and the carrier get everything filed and covered claims paid.

Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. Find an independent insurance agent in your community here.