Indiana Restaurant Insurance

Because Hoosiers need restaurant insurance coverage, too.

Indiana is a Midwest state that you may not associate with any particular type of food. And while the state certainly has its fair share of unique dishes, every Indiana restaurant has one thing in common: you need restaurant insurance. That means you also need an independent insurance agent to guide the way and give you the best of what any insurer has to offer. This guidance will cover everything from broad coverage categories to the risks that drive the policies you'll eventually purchase.

Risks in Restaurant Insurance in Indiana

But no two restaurants are the same. Every restaurant:

- Serves a different style of food

- Cooks food differently

- Is located in different buildings and types of buildings

- Has unique kitchen equipment

- Has unique personal property, from furnishings to décor

- Owns some specialty property, like a sign

- Has various staffing needs

An underwriter is responsible for carefully considering each to determine what it means for your restaurant insurance coverage. However, your understanding of how each of these factors, among others, affects your insurance coverage and costs is vital, too.

Three Types of Restaurant Insurance You Need in the Hoosier State

Restaurant insurance is three-fold. If you’re located in Indiana, you’ll need:

- Property insurance

- Liability insurance

- Employee insurance

For each of these categories of insurance, there is general coverage you need to pay for and more specialized coverage you can choose to include. Your independent insurance agent will help you determine which of the specialty coverage options make sense for your restaurant.

Property Insurance for Your Indiana Restaurant

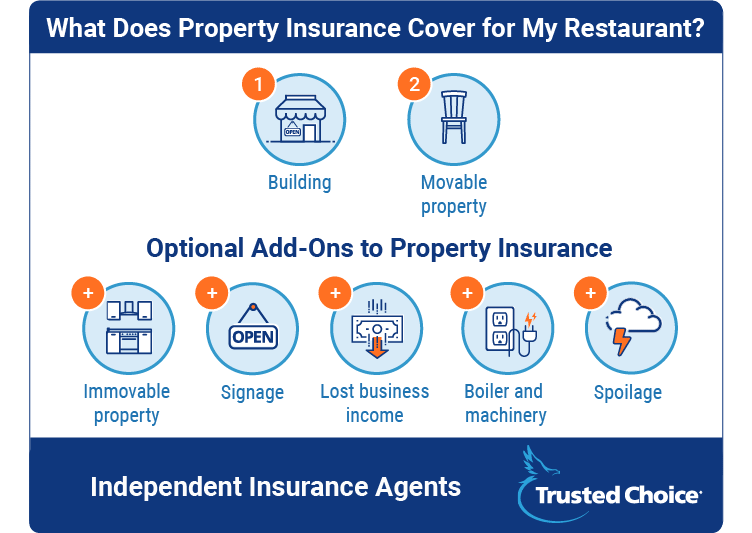

General property insurance pays out the replacement value of:

- Your building

- Property that you can move inside the building

However, there is more property in your restaurant than just movable property. In fact, you probably have certain property bolted down in the kitchen, or maybe even in a bar in your main seating area, that can’t move at all. It’s important to recognize that this property is not covered by a general property policy. And because this equipment can be quite expensive, it’s important that you discuss coverage options with your independent insurance agent. Aside from immovable property, there are other types of specialty property coverage that you should take under consideration, including:

- Spoilage: Spoilage covers the cost of food you lose if there is a refrigeration problem.

- Signage: How much does your restaurant sign cost? Some Indiana restaurants have signs that cost $50,000, and some others have signs that can push $100,000. If you have an expensive sign, you’ll need specialty coverage for that, too. Drive-though signs would also fall into this type of coverage.

- Lost business income: Fires, natural disasters, and other common problems are all covered losses. If any of these losses occur, lost business income coverage means you’ll get money to keep your bills and employees paid while repairs are completed.

- Equipment (boiler and machinery): If equipment breaks down, this coverage provides for the cost of the physical damage it might cause. If the electricity fails and causes damage to the wiring, the wiring repair would be covered.

Commercial General Liability Insurance for Your Indiana Restaurant

Commercial general liability is coverage for two things that might happen to customers on your restaurant’s premises:

- They fall or have a physical accident

- They eat something that causes illness

Liability insurance is common for a few types of incidents, including:

- Slips and falls, on a wet floor or in the parking lot

- Wrongfully prepared or spoiled food

You may need additional coverage for your general commercial liability policy. This includes coverage for:

- Liquor-related incidents

- Lawsuits brought against directors and other officers of the corporation

First, let’s talk about liquor. General liability coverage does not cover accidents related to alcohol. This means that if your Indiana restaurant sells, distills, or brews alcohol in any manner, you need this additional coverage. A liquor liability policy will pay for property damage and bodily injury arising out of any alcohol-related incidents. A unique type of liability coverage is directors and officers liability. Sometimes, disgruntled employees, stockholders, or even a city will bring a lawsuit against a company for what they view as a poor corporate decision. If they do, directors and officers liability coverage will protect against the litigation costs of this suit.

Employee Insurance for Your Indiana Restaurant

There are two types of employee insurance for your Indiana restaurant:

- Workers' compensation

- Employment practices liability insurance

Workers' compensation coverage is required for Indiana restaurants. It will pay out to an employee following an injury on the job for expenses like:

- Medical bills

- Lost wages during recovery

- Rehabilitation

Keep in mind that workers' compensation insurance considers the amount of your payroll (per $100) and the risk that your employees will be injured. This means that if you run a restaurant that involves open flames, knives, and hot oil for frying, you may pay more than you would otherwise. An optional type of coverage is employment practices liability insurance. This type of coverage protects your business and officers of the business from lawsuits brought by employees regarding:

- Sexual harassment

- Hostile work environment

- Bad behavior

- Discrimination

Litigation can be pricey. This insurance makes sure your business doesn’t suffer under the burden of impending lawsuits.

How Various Features of Your Indiana Restaurant May Affect Costs

The configuration of your business, how you choose to run it, and even various features of your building can affect insurance coverage and costs. While this could involve any number of features, it most often involves:

- Buffets: Underwriters generally don’t like buffets. They come with a higher risk of contamination and problems. So if you have a buffet, expect to pay a bit more.

- Drive-throughs: You might think that a drive-through comes with additional risk, but it doesn’t. The only implication is whether your drive-through sign is worth purchasing extra coverage for.

- Waiters vs. no waiters: Having a wait staff just means that you’ll have additional employees and need to pay more in workers' compensation coverage.

- Delivery: Delivery means you have to extend liability coverage to the cars. If you allow employees to use their own cars, you run the risk of higher liability coverage because there is more risk. However, if you purchase your own vehicles to use for delivery, you’ll save some of the liability costs because an underwriter can evaluate a policy more easily.

These are just a few of many factors that you may want to consider before you speak to an independent insurance agent about your coverage.

How Operating an Indiana Restaurant Affects Insurance Coverage

The basic differences in coverage from state to state will depend on the:

- Food

- How you prepare it

The Midwest is notorious for spoilage problems. The issue is that Indiana is not close to a coast, meaning that there is more frozen food. If a freezer stops working and the food goes bad, spoilage coverage will keep the restaurant afloat. The Midwest is also notorious for fried foods. If you have hot oil in the kitchen, there is more risk to employees and your liability and workers' compensation insurance costs may increase, too. But again, all of these issues are going to be unique to your restaurant so it’s important to think about what applies to you.

Insurance Costs for Your Indiana Restaurant

There are two separate payments that you’ll make for your restaurant insurance in Indiana:

- Property and liability

- Workers' compensation

Workers' compensation insurance is separate because it is calculated by payroll (by $100) and by risk classification (different jobs in your restaurant come with different risks). If you have a lot of employees and there is a lot of risk in your restaurant, then you’ll pay more. Basic property and liability coverage can cost as little as $1,000 annually and as much as $100,000 annually. The difference is in the size of the operation, the risks involved, and the other factors we’ve discussed throughout this article.

DID YOU KNOW?

A multi-location restaurant is going to have a lot higher policy cost than a corner hotdog stand.

Another factor that will play into cost is the personal property in the restaurant. If you have rare property or other valuables, an appraisal is key to ensure that you’re paid properly should something happen. Specialized policies can also increase costs.

An Independent Insurance Agent Can Help with Your Indiana Restaurant Insurance Needs

Remember, you need restaurant insurance coverage for:

- Property

- General commercial liability

- Employees

It doesn’t matter what kind of restaurant you run, or how you run it: An independent insurance agent is your best resource. Talk to your agent to run through all of the factors and features mentioned here to ensure that you get the best policy at the best price.