Tennessee Restaurant Insurance

Make your coverage the only ten-you-see.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Ready to open the perfect 10 out of 10 restaurant in Tennessee? Literally, the only “ten” any of your customers “see?” Okay, maybe that’s a bad pun. But you know what’s not bad? Calling up your independent insurance agent to ensure that your restaurant insurance scores a perfect 10 out of 10 every time.

What Is Restaurant Insurance?

You know what insurance is, but restaurant insurance is a whole different world. It's coverage for everything - and we do mean everything - related to your restaurant. This means coverage for things like your property, customer risk, employees and everything in between. It's important to note that there are general policies, and then there are specialty policies. The good news is that an independent insurance agent will help you work through all coverage issues to ensure you don't miss any risks and are protected, no matter what may occur.

Get That Property Covered

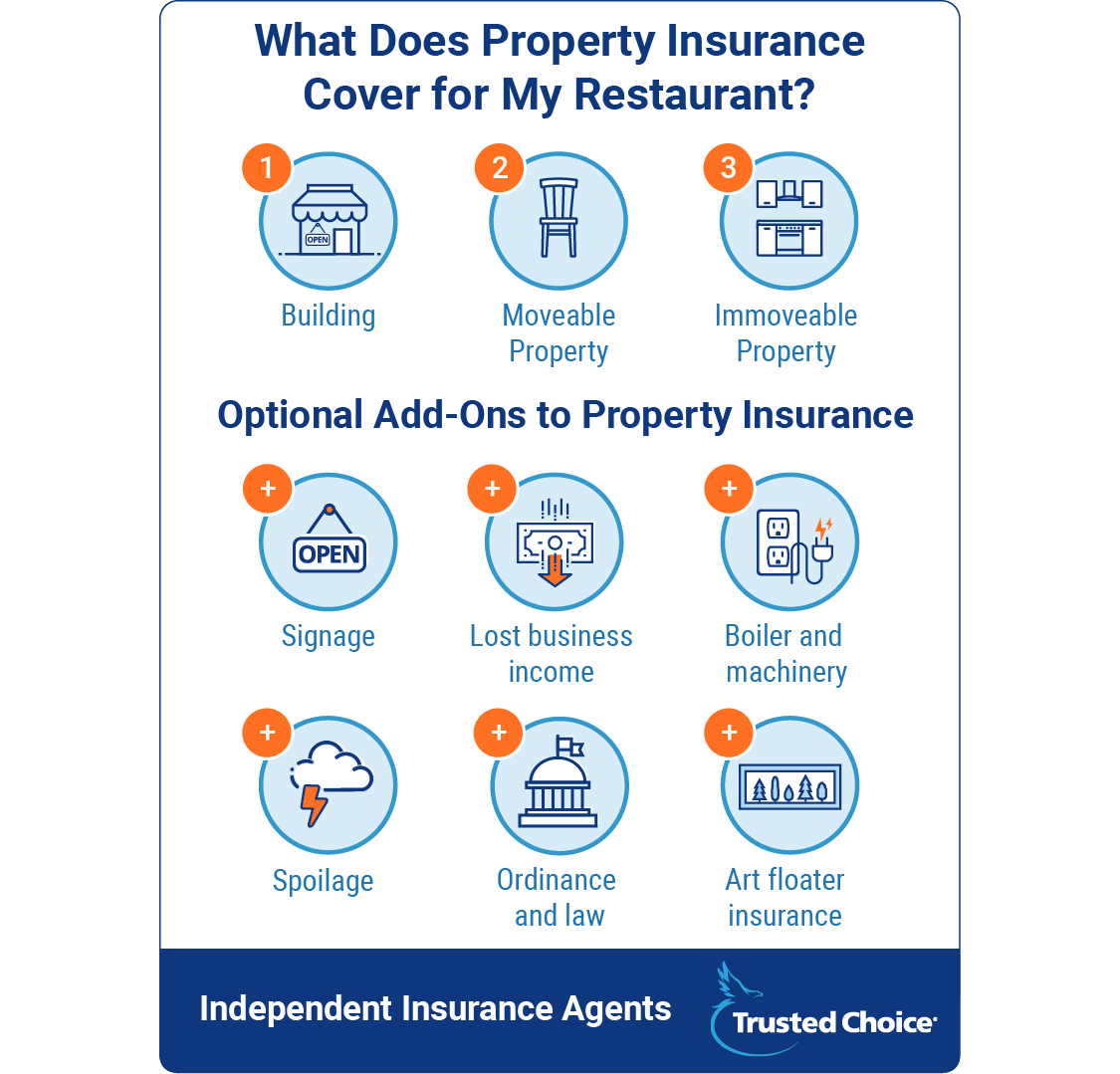

Step 1: Property insurance. You have a building. Or, at the very least, some kind of food cart or truck or something. That needs insurance. You know what else needs insurance? The movable property you put in that restaurant. Movable means you can move it, or someone stronger than you can. Then there’s immovable property. Some kitchen equipment is bolted down. Some furniture might be built-in. If this is true, and it is for most – minus those truck and food stand people – you’ll need an additional policy for the immovables. Or if you don’t for some reason, your independent insurance agent will know how or why.

Note here that the cost of your property coverage will depend on more than just your building and the property inside it. One example is the type of kitchen equipment you have. If you're cooking over an open flame, your property coverage is going to cost more because there's more chance that you're going to have an accident and file a claim. There’s other property, too. This might include:

- Signs: Front and drive-thru signs can cost tens of thousands of dollars. General property coverage isn’t going to cover that. Because vandalism, a natural disaster, or your common car accident can destroy your signs in an instant, it makes sense to get yours covered under a separate policy.

- Spoilage: Have you ever thought about how much food is lurking in that freezer of yours? Too much to just go to waste. Spoilage coverage pays for food that goes bad because of a refrigeration- or freezer-related issue.

- Lost business income: Let’s say there’s a tornado, fire, or whatever nightmarish disaster you want to unleash in that twisted imagination of yours. Chances are, your restaurant is going to be shut down for some time. And if it is, lost business income pays for your bills and expenses – including employee salaries – until you’re ready to reopen.

- Equipment (boiler and machinery) coverage: This pretty little policy covers damage to wiring, plumbing, or other systems when a larger piece of equipment breaks down. But be warned: It doesn’t cover the cost of repair to the larger system itself.

- Ordinance and law: State codes are important. Think of everything from your handicapped compliance to your fire safety to emergency exits. This coverage would also apply if you're rebuilding or are building from the ground up.

- Art floater coverage: If you have specialty property in your restaurant, like art, you should get that covered. After all, you want the full value if it's destroyed or stolen. Appraisals are a key part of this coverage for that reason (in fact, they're the first step).

Get That Customer Liability Covered

Customers are expensive. They eat food that makes them sick (food poisoning or poor preparation), or they slip and fall on a wet floor or some food, and all of a sudden you’re getting sued. The point of general liability insurance is to keep you covered in these types of situations. Communicable disease is another common type of liability coverage. It kicks in when your employees may not take the whole "wash your hands before you go back to work" thing seriously. If a customer gets sick because of hygiene-related issues, you're covered.

Then there’s the whole alcohol problem. If you serve, brew, distill, or do basically anything with alcohol on your premises, you need a liquor liability policy. Why, you ask? Because your general liability coverage isn’t going to kick in if the property damage or bodily injury is because you overserved a customer, unfortunately. And because a lawsuit like this could easily tank a business – especially a restaurant that’s just getting started – coverage is key. Note that smaller restaurants are more likely to purchase liquor liability policies in contrast to chains because chains tend to have stricter serving policies. However, you should discuss this coverage with your independent agent regardless to ensure that you aren't missing out on key coverage.

One more type of liability coverage is officers and directors liability. This is the type of coverage you get when you want to protect against the fallout if stockholders, employees, or an entire city – yes, a city – sue you for a bad business decision. That’s right, all it takes for a lawsuit like this is someone calling you out for a decision that negatively affects your company. But if you’re confused about whether this special policy is worth it, it’ll remind you why your independent insurance agent is worth it.

Tennessee Dram Shop Laws

Dram shop laws are state laws that allow an injured person to bring a lawsuit against a vendor that sold alcohol to an intoxicated individual who caused an accident. However, Tennessee's law permits recovery only in certain circumstances. Specifically, Tennessee's dram shop laws provide that a person can bring a claim only if:

- The vendor sold the alcohol to the intoxicated person

- The person who purchased the beverage was a minor under age 21 or was visibly intoxicated, and

- The sale of the beverage was a direct cause of the injury

The standard of proof is high in Tennessee, too. Anyone bringing a claim must convince a 12-person jury that all of the elements listed above exist beyond a reasonable doubt. This makes it harder for a person to recover damages in Tennessee, but not impossible. And, as you might imagine, it makes it all the more important that you discuss Tennessee's dram shop laws with your independent agent when you're talking liquor liability coverage.

Get Employees Covered with Workers' Compensation Insurance

If you live in Tennessee, you’re legally required to purchase workers' compensation coverage. Workers' compensation kicks in when an employee is injured on the job. It covers things like medical bills, rehabilitation costs, and lost wages. Then there’s employment practices liability insurance. It’s coverage for when employees turn against you. That sounds barbaric – it’s really for when employees file some kind of lawsuit, whether it’s because of sexual harassment, discrimination, or some other employment-type suit. This might not seem like a big deal, but lawsuits can get drawn out and litigation costs can be high. So you’ll be grateful you have this coverage if and when it happens.

Features Matter for Coverage

Features matter because they can change coverage. Well, at least some do. So it’s important that you understand the ones that do and the ones that don’t, so you sort of know whether to adjust your pricing expectations upwards (or downwards). First off, let’s clear out the features that won’t affect your coverage much. The most surprising is a drive-thru. A drive-thru only affects your property coverage to insure the pavement and the sign. Buffets shouldn’t affect your coverage either but sometimes do. But if they do, it’s pure underwriter bias.

Then there are the things that do matter: delivery services and whether you’re a carry-out or dine-in type of place. Delivery affects liability coverage and affects it more if that liability coverage is for your employees’ own vehicles. After all, if you buy vehicles for employees to use, they’re going to be nicer, newer cars than if you allow employees to use their own vehicles. But the downside is that this obviously costs some money. If you're operating a food truck, you'll need liability coverage for that, too.

Then there's the dine-in vs. carry-out issue. Think this one through with us. If you’re a dine-in restaurant, you’re going to have a bigger building with more furniture, a bigger kitchen with more equipment, customers that are actually on your property, and more employees to wait on all of those tables and prepare more food. That would mean increases in property, liability, and workers' compensation coverage.

How Much Does Tennessee Restaurant Insurance Cost?

Or I guess we’d really be showing you the insurance premium bill. In any case, you want to know how much all of this is going to cost. And we’re going to give you the answer you don’t want to hear: It depends. One thing that we can tell you for sure is how costs break down. Generally speaking, costs are divided in two:

- Workers' compensation

- Property and liability

Workers' compensation is priced per $100 of payroll and by risk classification. Risk classification is affected by things like sharp objects, hot oil, open flames – anything that can and will hurt employees at some point. There’s a lot of deep-fried food in Tennesee, so your risk classification might be a little higher depending on what kind of food you’re serving. Property and liability coverage is a package deal, and it’s different. It’s generally affected by the type of restaurant you’re looking to open. If you’re going to open a corner hotdog stand, you probably aren’t going to owe more than $10,000 annually for insurance coverage. And this makes sense.

You have limited property, you don’t have customers on your premises dining in, and you don’t have many employees. This is why a food cart, food truck, or other sort of small stand is the safest and cheapest way you could possibly start a restaurant. If you’re opening more of a traditional restaurant, coverage costs will be higher – up to $100,000 annually for some! Before you lose your lunch, this is more for your multi-location, chain-esque type restaurants. They’re the ones with tons of property, customers dining in, and thousands of employees.

They're also more likely to need specialty policies to cover artwork, additional liabilities, or other issues. That's why it shouldn't come as a surprise that these are the priciest and most difficult restaurants to start. You’re more than likely going to be in a happy medium somewhere, and it all just depends on your restaurant, your dream, and what you end up bringing to the table (literally and figuratively).

Talk to Your Independent Insurance Agent

Your independent insurance agent is the only resource you need. They're an expert at all things Tennessee restaurant insurance, so you’ll get the coverage you need, leave behind what you don’t, and be well on your way to a 10/10 restaurant, guaranteed. The best part is that an independent agent does the heavy lifting for you. Your agent will know how to navigate the ins and outs of coverage and get you to where you need to go. It's time you made the call.