Golf Course Insurance

(Here’s how to shop smart and get the coverage you need at the right price)

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

23 million adults played golf in 2017, and it’s not hard to see why. Golf is a relaxing way to have fun and stay in shape. What those players may not realize is that their good time is protected by a secret superpower: golf course insurance.

Golf course insurance covers your course in case of disaster, helping you stay solvent and make repairs fast. We’ve got the 411 on the who, what, and why of buying.

Once you’re ready to shop, our expert independent insurance agents are on hand to handle the fine print for you, so you can focus on keeping those hole-in-ones coming.

What Is Golf Course Insurance?

Golf course insurance is a type of business insurance specially designed to cover the needs of a golf course. As with all business insurance, that means it’s a blend of several different types of coverage.

Here are the most common types of insurance that may be included in a golf course insurance policy:

- General liability: Covers legal expenses in case of a lawsuit.

- Liquor liability: Covers legal expenses specifically related to serving alcohol, like drunk driving cases.

- Directors and officers insurance (D&O): Covers board members and other senior leaders in your organization if they’re sued based on decisions they made for your organization.

- Commercial property: Covers buildings and other property, like furniture, in case of natural disaster or other damage.

- Flood insurance: Covers flood damage which isn’t covered by normal commercial property insurance.

- Commercial auto insurance: Covers vehicles, like maintenance trucks or courtesy cars, in case of accidents.

- Inland marine insurance: Covers equipment that moves, like golf carts or lawn tractors. May also cover the green or special course features like trees that aren’t covered by commercial property insurance.

- Workers' compensation: Covers worker expenses if they are injured on the job.

It’s smart to change up your coverage over time as your needs change, which an independent insurance agent can help manage. Larger courses will need more insurance, especially if you want to host special events like weddings or tournaments.

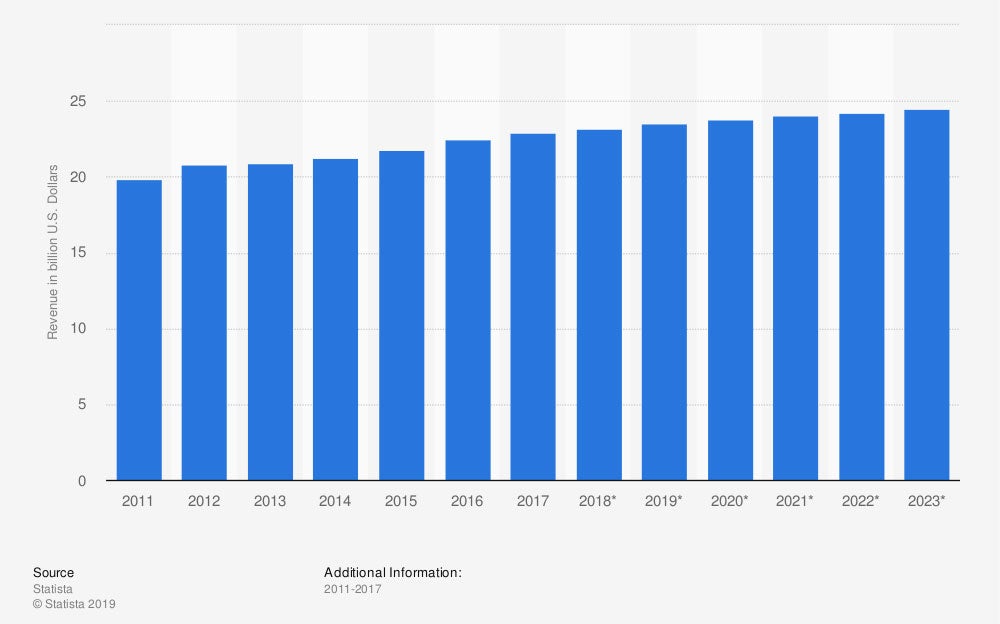

Golf course and country club industry revenue is projected to increase to nearly 25 billion by 2023. Golf course insurance helps you protect your piece of that pie.

Industry revenue of "golf courses and country clubs" in the U.S. from 2011 to 2023 (in billion U.S. Dollars)

Why Is Golf Course Insurance Important?

Buying a bunch of insurance coverage for your golf course can feel like an expensive waste of time, especially if it’s small. That’s why we’re here to demystify the process, and talk worst case scenarios.

Golf courses face many unique business challenges. Golf course insurance helps you handle them or even avoid them altogether. Here are a few examples:

Lawsuits: Liability insurance pays for a lawyer if you’re sued and protects your golf course from being on the hook for major legal settlements if you’re found liable, like in these scenarios:

- You’re sued for racial, gender or similar discrimination (especially important if you run a country club or other members-only organization).

- You’re sued because a customer was overserved at a bar and got into an accident.

- You’re sued because a customer was injured by a flying ball or another feature of your course.

Natural disasters: If your buildings, equipment, vehicles or green are damaged in a wildfire, hailstorm, or other natural disaster, insurance has you covered. You won’t need to pay out of pocket to repair or replace things, helping you get back on your feet faster.

Theft and vandalism: As with natural disasters, insurance has you covered if your course is the target of thieves, vandals, and even rioters.

Car accidents: If a company vehicle gets into an accident, your regular car insurance won’t cover it, but commercial auto will.

Worker injuries: Everything from a golf caddy’s sprained ankle to a kitchen worker’s nasty burn can be covered under workers' compensation if your employees get hurt on the job. This saves you from needing to pay for costly medical bills and time off work yourself.

Special events: If you dream of hosting weddings, tournaments, or charity fundraisers at your course, insurance is a must. Liability insurance shields you from suits over events gone wrong, and commercial property insurance helps you repair fast in an emergency.

Getting business loans and other financing: If you’re planning to finance your business, your bank will likely require you to have insurance so that they can be sure you’ll make payments even if there’s a disaster. Ditto investors, who want to protect their investment.

In short, there are nearly endless reasons why golf course insurance is a good idea, but only two that can make it seem like a bad idea: time and money paid out in premiums. Ultimately, those are a small price to pay for the long-term stability and success of your golf course.

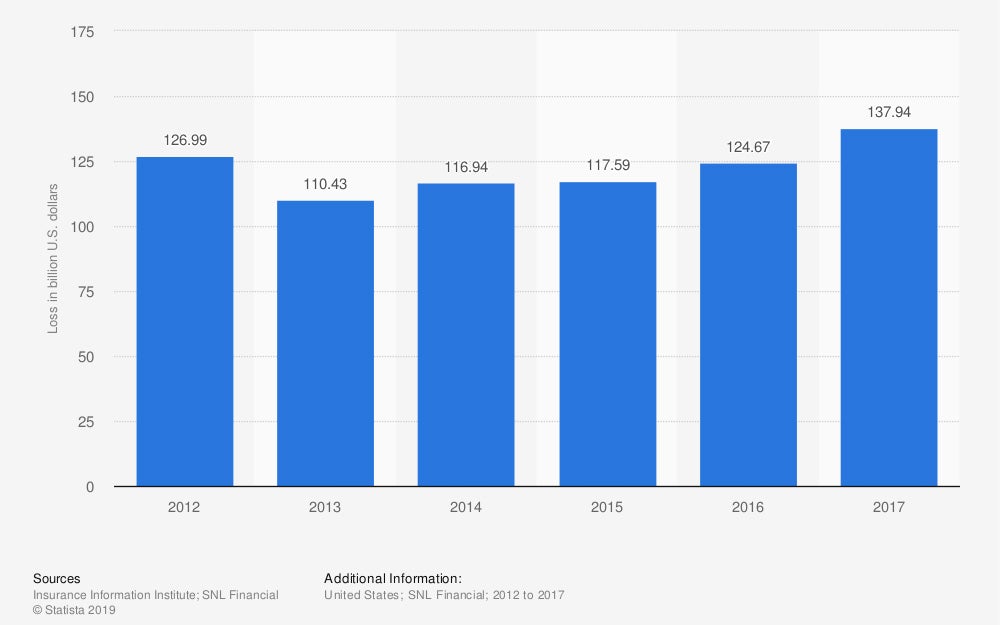

Incurred losses for commercial insurance in the United States from 2012 to 2017 (in billion U.S. dollars)

Businesses incurred losses of over 137 billion dollars in 2017 to physical damage, legal costs and more. Luckily business insurance was there to pick up the tab for them. Make sure it's in place to pick up the tab for you, too.

How To Get Golf Course Insurance

Start by contacting an independent insurance agent who’s competent in business insurance, preferably one who’s already handled other golf courses. Your agent will ask you some questions and fill out applications that they’ll send in to insurance companies to get you some quotes to compare.

Once you get your quotes, you’ll compare price and coverage to find the right package for your course. Don’t automatically go for the cheapest option. Ideally you want the most cost-effective option.

A cost-effective option will have thorough coverage in the areas that are most important to you while also being affordable. Don’t be afraid to ask your agent lots of questions in order to find the best option. Shopping for insurance with an independent insurance agent should be a collaborative process.

How Golf Course Insurance Quotes Work

An insurance quote is a package put together by an insurance company made up of a price and the coverage options they’re offering. It’s based on your golf course’s size, location, and risks, such as whether or not you serve alcohol.

A quote may be highly customized, or “out of the box,” based on the general needs of a golf course. It may or may not be discounted depending on various safety factors.

How To Get a Quote

If your golf course has been owned and insured previously, then getting a quote for it is easy. Insurance companies will be able to access previous information about the property which they will use to generate a price and coverage options.

If you are building a brand-new golf course, or your golf course has somehow never been insured before, then the process is slightly trickier.

A previously uninsured golf course will likely need to undergo a loss-control survey. Luckily, this process requires little input from you. You’ll just need to be present during a visit from the insurance carrier who will inspect the property for unique needs and risks that will affect your quote.

If you’re stressed or confused about this visit from the insurance company, our independent insurance agent can fill you in on what to expect, how to prepare, and what it all means for your course.

How Much Does Golf Course Insurance Cost?

This varies so widely from golf course to golf course that it’s impossible to give a good estimate, but plan on your golf course’s insurance costing at least a few thousand dollars per year. Top tier courses may pay tens of thousands of dollars per year.

Factors that influence the cost of golf course insurance include your course’s location and vulnerability to crime and disaster, the size of your course, the replacement cost of buildings and equipment, and whether or not you serve alcohol.

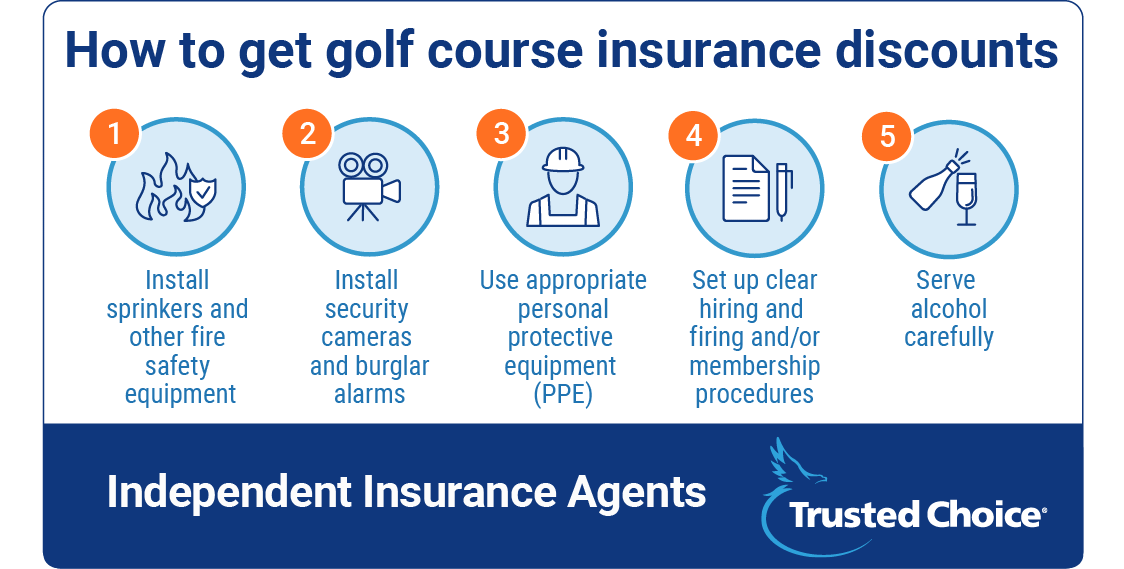

How To Get Golf Course Insurance Discounts

Insurance discounts rarely work like 10% off coupons at a grocery store. Instead, they’re based on complicated math about the unique risks faced by your golf course. In short, if you make choices that save the insurance company money, they may pass those savings onto you.

Here are a few simple ways to up your chances of getting a golf course insurance discount:

- Install sprinklers and other fire safety equipment: Lowers the risk of fire and reduces damages if fire does break out.

- Install security cameras and burglar alarms: Deters criminals and catches them red-handed if they do strike.

- Use appropriate personal protective equipment (PPE): Keeps employees safe during potentially dangerous jobs like lawn care and deep cleaning, reducing workers' compensation claims.

- Set up clear hiring and firing and/or membership procedures: Transparent rules around hiring and firing or membership to your club reduces the risk of discrimination lawsuits.

- Serve alcohol carefully: Train bartenders on how to avoid overserving. Some insurance companies may even help you run this training.

When comparing quotes, don’t be shy about asking your independent insurance agent about which discounts have been applied and if there are any more you might qualify for. They want to help you find insurance you’re happy with.

The Benefits of an Independent Agent

Insurance is sold in two ways: by “captive” agents working for a single company, and by independent agents who are free to shop around to find a variety of deals for you to choose from. Independent insurance agents are the ultimate comparison shoppers.

Independent insurance agents are also experts in their field who are there to help you make important insurance decisions confidently. They’ll fill out paperwork and handle red tape for you, so you can focus on running your business.

Whatever you choose, we wish you and your golf course the very best.