North Carolina Restaurant Insurance

Coast through coverage questions, East Coast style.

You’re stepping out of the shadows of family and friend cookouts and into the big leagues. You’ve found the building, you’ve got the menu set, and it’s time to unleash your culinary genius onto the world. And just like you’re unleashing your recipes to the masses, you’re also unleashing some serious risks to customers and employees alike. Luckily, risk is a whole lot less risky when you’ve got an independent insurance agent helping with your restaurant insurance. No matter what kind of cuisine you serve, how many employees you have, or what else you’re bringing to the table, your independent agent's got you covered.

Let’s Get Back to Basics, Shall We?

If you know which kinds of insurance restaurants have, you’re in the right place. And if you don’t, you’re also in the right place. The basics are pretty…basic. You need:

- Insurance for your building and the stuff you put inside it

- Insurance for your customers, in case they get sick or hurt

- Insurance for your employees, because they keep your restaurant afloat

Property Insurance for North Carolina Restaurants

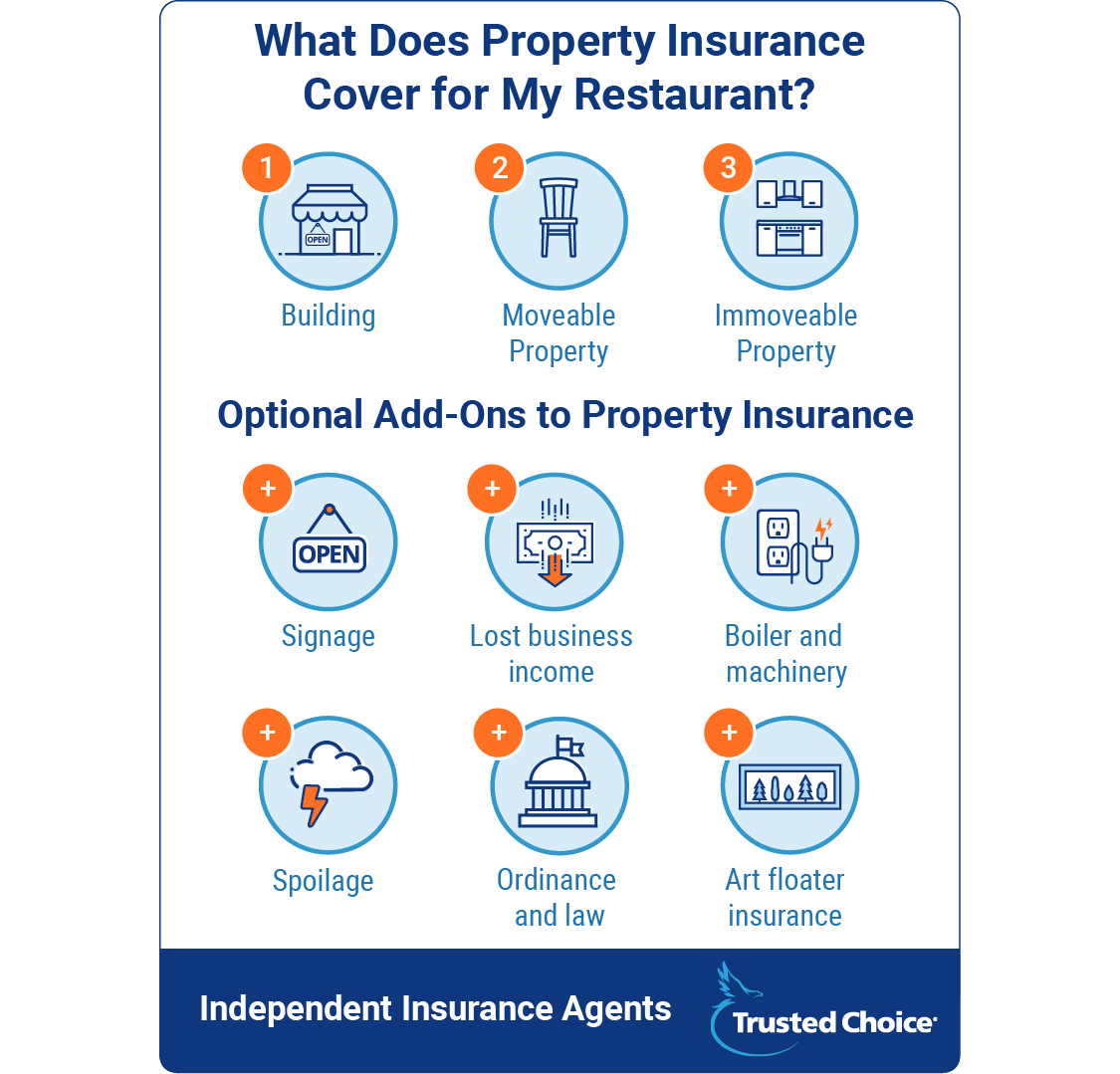

Property insurance is a lot like how it sounds: It’s insurance for your property. A general policy includes real property (i.e., real estate, like your building) and personal property (as long as you can move it). Movable personal property is stuff like chairs and tables, or the fancy things you hang on the wall because you’re artsy and you need the world to know it. Then there’s immovable personal property. Immovable property is stuff that’s bolted down. Think things in the kitchen like your grills or other appliances, or maybe even a bar in your dining area.

Now, kitchen equipment can be expensive. So if you have equipment bolted down, talk to your independent insurance agent about whether you need more coverage. That’s not all of your property. You’ve got special items, like a sign and intricate boiler and machinery equipment, that you should get covered. Lucky for you, your independent insurance agent can cherry-pick the policies you need and leave out those you don’t. Here’s a bit more background on each so you can bring something to the conversation with your agent:

- Signage: A sign can cost some restaurants up to $100,000! Weather, vandalism, and accidents can all cause damage to your sign. This isn't covered by your general property policy, so it's an additional policy you may want to get added.

- Lost business income: Hurricanes and kitchen fires could close your restaurant down. And when you’re getting repaired, lost business income pays your bills (and employees).

- Equipment (boiler and machinery): When equipment breaks, it can cause damage to wiring, pipes, and all that other stuff in your building you don’t know much about. Property insurance sometimes covers this, but not always. This is something you'll want to talk to your independent agent about.

- Spoilage: Food goes bad. If your food goes bad because your fridge or freezer has a meltdown, spoilage coverage will keep you feeling cool.

- Ordinance and law: Ordinance and law are another part of property insurance that covers the financial ramifications if your building isn't up to snuff with state codes. If you are just breaking ground on your restaurant, or if you need to rebuild, this coverage matters - so do handicapped-compliant features, fire safety equipment, and emergency exits.

- Art floater coverage: If you have special property, like artwork, get it appraised. It won't be covered under a general policy and you need to have the proper value to ensure you get back what you lost if there's a fire.

Hurricanes are Another Factor to Think about for Property Coverage

In North Carolina, you’ve got hurricanes to worry about, too. After all, the number of hurricanes has been increasing in North Carolina over the last century. This includes the Virginia Beach/Norfolk region of North Carolina, which is up there on the list of US destinations likely to get hit by a hurricane. This will probably mean you pay a smidge more for property coverage. However, it's something you can speak about with your independent insurance agent in greater detail to determine whether it's necessary.

Liability Insurance for North Carolina Restaurants

Liability insurance is for customers. General coverage has your back if someone trips and falls or eats something that’s past its prime. This can be a big concern in coastal restaurants that serve seafood since even minor slipups can make customers really sick. Then there are the fancy liability policies. The first is liquor liability. If you serve, brew or distill alcohol, or even think about doing any of those things with alcohol (kidding, of course), you need liquor liability coverage. It pays for property damage and bodily injuries that might happen if you overserve a customer and they get behind the wheel of a car. Dram shop laws factor into this, too. But more on that below.

Communicable disease is another type of liability coverage that most restaurants should have. Not every employee washes their hands or takes other proper hygienic precautions. This coverage pays for the cost of any illnesses caused by your employees' improper hygiene. One last type of liability-coverage is directors and officers liability. It sounds complicated, but it really just means that if you own a larger restaurant, and stockholders, employees, or cities decide they don’t think you made a good decision, they’ll sue. This is much more specialized coverage, so you might not need to worry about it. But if you do, your independent agent will know the drill.

North Carolina Dram Shop Laws and Liability

Dram shop laws make your restaurant liable if you serve alcohol to a minor or overserve an adult. North Carolina has dram shop laws that will affect how much you have to pay if you break the law, which can also affect the cost of coverage. In North Carolina, it's unlawful if one of your employees knowingly sells or gives alcoholic beverages to a person who is intoxicated. Although the statute says that the sale has to be "knowing," negligent sales are often punished, too.

Then there's a distinction between first-party and third-party liability coverage. First-party coverage means your restaurant is liable to guests. Generally speaking, guests must monitor their own consumption, but if you serve a minor, you're on the hook. Third-party coverage is what a liquor liability policy would cover. It protects against property damage or bodily injury when one of your intoxicated guests gets in an accident or a fight with a third party. Lawsuits are costly. Dram shop laws affect coverage and how much you'll owe should something go wrong. Your independent agent in North Carolina will know the dram shop laws inside and out and make sure you've got the proper coverage.

Workers' Comp Insurance for North Carolina Restaurants

Employees are the lifeblood of your restaurant. They keep it running, and if one of them gets hurt on the job, employee insurance will keep them running, too. The law says you need workers' compensation coverage if you’re running a North Carolina restaurant. This means that if an employee is hurt on the job, this insurance will cover their:

- Medical expenses

- Lost wages

- Rehabilitation costs

Then there’s employment practices liability insurance. This pretty little package will pay for lawsuits brought against your company and any officers, whether because of alleged bad behavior, sexual harassment, discrimination, or a hostile work environment.

Why Features Matter

Features is a pretty general term. But when we say features, we mean anything and everything, from having a buffet to being a carry-out restaurant rather than a sit-down joint. While you might not think that these features change much, they can. Think about this: A buffet keeps food out in the open. Underwriters, even if they have no real reason to, generally up the cost of insurance because of one. There’s no rhyme or reason to it – but if you have a buffet, beware.

Drive-thrus can affect coverage, too. There's additional property, and the pavement isn't typically covered by your general property insurance. However, this shouldn't add too much to your necessary coverage. Then there’s the debate about having a wait staff vs. being carry-out only. The difference here is a bit more obvious: If you have a wait staff, you’ll have more employees and pay more in workers' compensation. You’ll also pay more in liability because customers are more likely to have an accident if they’re spending more time in your restaurant.

Delivery is another feature that can drive up the cost of insurance. Specifically, it'll drive up liability coverage. It might be worth your while to purchase your own delivery vehicles. Otherwise, you’ll pay the cost of covering your employees’ cars. This can be tricky because some might be old or have some serious problems. So while vehicles are an up-front investment, it could save you money (and some peace of mind) down the road.

How Much Does Restaurant Insurance Cost in North Carolina?

First thing’s first. Costs are broken into two rates. You’ll pay one rate for your property and liability restaurant insurance, but you’ll pay for your workers' compensation insurance separately. The reason is that workers' compensation is priced per $100 of payroll and by risk classification. Think sharp knives, hot oil, and all the other risks lurking in the back-end of your joint. Property and liability are different. Let’s say you’re opening a beachfront hotdog cart. It’s operated by you and maybe one other employee, there’s not a lot of risks involved, and you barely have any property. You might only pay $1,000 annually for property and liability coverage in a situation like this.

On the high end, you might be opening a multi-location restaurant that is dine-in and has hot oil, sharp knives, and other hazards galore in the kitchen. If that’s the case, you have lots of property, lots of risks, and a lot more to pay for if something goes wrong. This could mean that your coverage is close to $100,000 annually, if not more. It all just depends on what your restaurant brings to the table, and what your independent insurance agent thinks your North Carolina restaurant needs to stay in the clear coverage-wise.

Get an Independent Insurance Agent and Get Covered

Independent insurance agents make your life easier. They know what kinds of coverage you need, which special add-ons you’ll want, and everything else to make sure that when you finally open that North Carolina restaurant, you’re covered. This means you'll get the best possible deal with the right policy coverage. It also means that you don't have to sift through the insurance world's jargon.

Instead, you'll talk to an agent in plain English and get everything you need to get your restaurant off the ground.