Wisconsin Farm Laws & Regulations

(What you need to know and how insurance applies)

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

So you own or are thinking of owning a farm in the great state of Wisconsin...well, Wisconsin has more than just cheese. When it comes to Wisconsin farm and agriculture laws, there's a lot that needs to be noted because there are a number of laws. But not to fear, read on for a few key laws that may affect your farm and your insurance coverage.

Your independent insurance agent is a fine resource when it comes to knowing all that goes into farming, how to cover it, and what laws need to be considered.

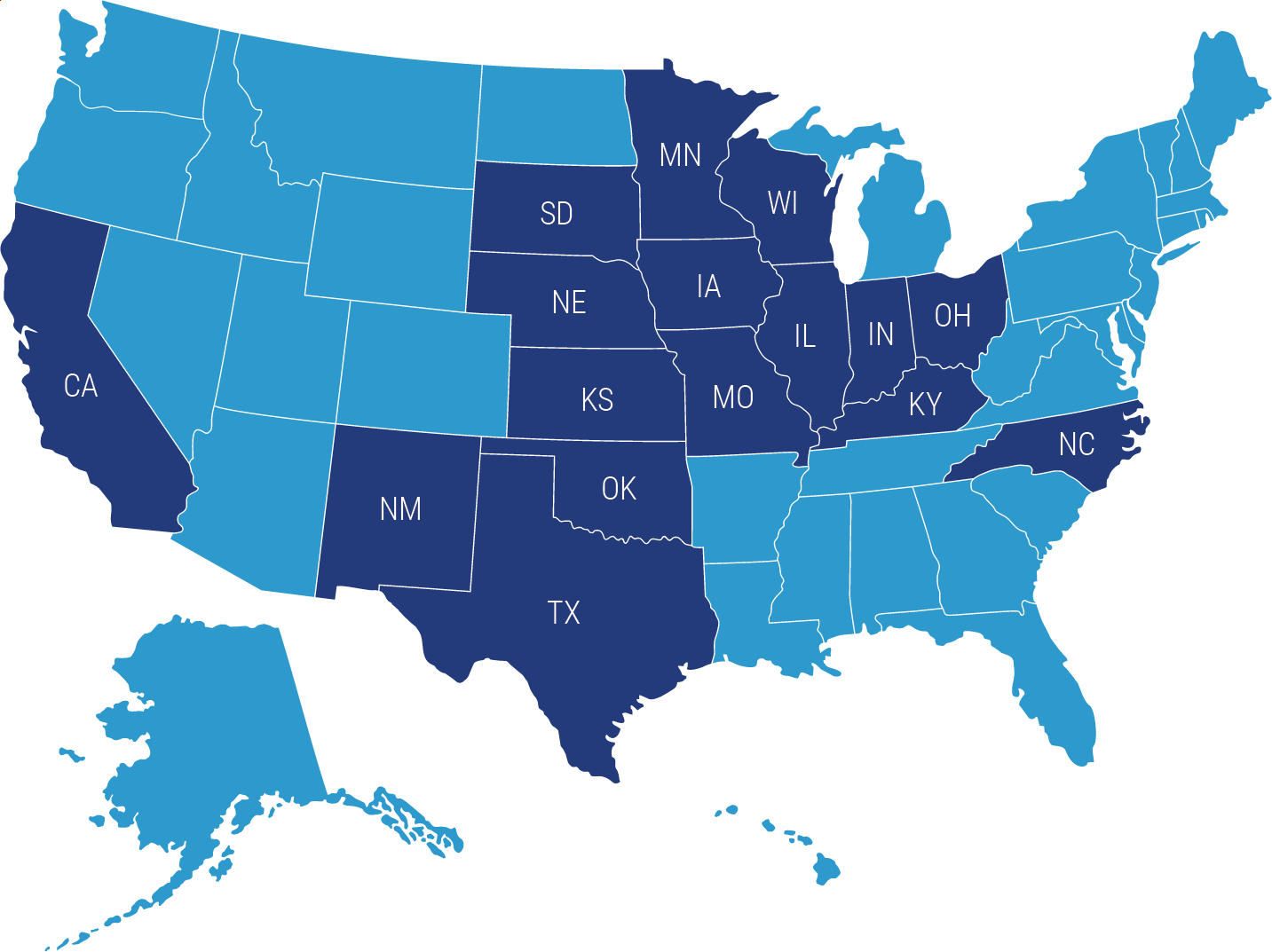

Are You in One of the Top Farming States?

There are a lot of states with farms, but among the 50, Wisconsin is one of the top 16 states with the most farming. Knowing how the state laws and regulations apply if you live in one of these states will help when you are setting up your insurance policies and making sure you are on the right side of the law.

| Key 16 States | Number of Farms |

| Texas | 247,000 |

| Missouri | 95,200 |

| Iowa | 86,000 |

| Ohio | 77,800 |

| Oklahoma | 77,300 |

| Kentucky | 75,100 |

| Illinois | 72,000 |

| California | 69,400 |

| Minnesota | 68,500 |

| Wisconsin | 64,800 |

| Kansas | 58,900 |

| Indiana | 56,100 |

| North Carolina | 46,400 |

| Nebraska | 45,900 |

| South Dakota | 29,600 |

| New Mexico | 24,700 |

Next, going over some Wisconsin state laws and regulations and how they may affect your farm, big or small, is what this article is all about.

Wisconsin Agricultural Laws and Your Insurance

Wisconsin is like most states which address agriculture in their laws. What it means for your farm will be based on laws that apply to your farm's operations as a whole. It's safe to say that most farmers have some aspect of agriculture at their farm, so you should know the laws.

Agriculture is defined as the science or practice of farming, including:

- The cultivation of the soil for the growing of crops

- The rearing of animals to provide food, wool, and other products

So that being said, there are a lot of insurance coverages and a lot of laws that fall under agriculture in Wisconsin. Going over what pertains to your farm with your independent insurance agent will make certain you are properly covered.

Wisconsin Livestock Laws and Your Insurance

Your farm's livestock needs to be healthy, not only to produce a bountiful livelihood but to also make sure your farm is staying within proper Wisconsin state laws. In Wisconsin, there are regulations and laws that are to be followed concerning livestock disease reporting, prevention, and control. The Wisconsin Department of Agriculture, Trade, and Consumer Protection's Division of Animal Health is responsible for disease control and animal health.

Once a disease gets rolling and proper guidelines aren't followed to contain it, it can spread faster than wildfire, infecting not only your herd but neighboring ones. Your livestock insurance will provide coverage if your livestock are attacked, get caught in a barbed-wire fence, are stolen, as well as for covered perils such as fire and weather. It will not, however, provide coverage for disease. Keeping your herd up to par when it comes to health could save you a whole lot of trouble and money, plus make you a good neighbor to surrounding farms.

Wisconsin Pesticide Laws and Your Insurance

Wisconsin has a pesticide law in place that protects human health concerning the transportation, disposal, use, labeling, storage, distribution, and application of pesticides. If you are caught doing any of the above in a harmful way or not keeping to the pesticides' intended use, then you could not only have to face legal consequences, but your insurance policies could have implications as well. The Bureau of Agrichemical Management regulates and controls the pesticide and fertilizer use.

Your pollution insurance should be an endorsement or additional policy on your farm insurance. It will provide coverage if you get sued as a result of pollution and will potentially pay for any cleanup of a pesticide or pollutant. But as with any insurance, if your intent was malicious in nature or harmful or careless, then your policy may void the claim and cancel coverage altogether.

Handling harmful chemicals the proper way is smart, and your community will thank you and so will your insurance company. The safer you are, the lower your premiums and the more you save. It's all about trust.

Wisconsin Food Code Laws and Your Insurance

You will find these laws and insurance coverages in every state. The way your food is manufactured, transported, and handled is all regulated. If you are a farmer and your crops are being sold to the consumer for food consumption, then Wisconsin has something to say about that.

The Wisconsin Food Code was established to break down by category every type of food that can be consumed, the way it can be consumed, and how it needs to be regulated. There is a many page law in effect that goes over each and every type, section by section, that the Food Code addresses.

Your insurance concerning food and your farm's food products go hand in hand with state laws. They require you to follow the proper channels when it comes to selling your farm's food to the general public. They will want you to have spoilage coverage if your food spoils and you need it replaced. There is also food poisoning coverage that protects the consumer if they get food poisoning from your product and sue your farm for damages.

Talk with your independent insurance agent to make sure your farm food product is pure and clean, and ready to be insured properly.

The Cost of Farm Insurance Coverage

Just like no two states are alike, no two farms are alike. So when it comes to estimating the cost of farm insurance, there's really no way to give you an accurate figure. Every farm will have different needs, and those needs determine the amount of coverage your farm should have in place. However, there are some risk factors that could cause your premiums to up or down depending on what your farm's specifics are.

Farm premium determining risk factors:

- Claims: Have you had prior farm claims? If so, your farm policy will most likely put a surcharge on your farm insurance to account for the loss for up to five years.

- Inventory: What does your farm have in stock? How many seeds, crops, livestock, herds, poultry, and so on do you have that would need to be replaced if a major loss occurred? The more you have, the more the premium.

- Equipment and machinery: What pieces of equipment and machinery does your farm have and what are they worth? The more money they cost, you can assume the higher they are to insure.

- Farmhouse: What does your farmhouse look like? Is it old or new, big or small? Is it updated with the finest furnishings or does it have a lackluster appeal? The fancier your farmhouse is, the more it may cost to replace.

- Pole barns and other structures: What is your barn situation? How big is your barn? How many barns do you have? What are they made of?

Where to Find Farm Coverage in Your State

It's only natural to want the best, and why shouldn't you have it for your farm? Well, finding the best farm insurance company can be a daunting task if you do it all alone. Because what's best for you may not be best for every farmer across America. Having a knowledgeable independent insurance agent in your corner and in your state is your best option. They work with carriers of all kinds each and every day and know all about the most reputable carriers with the best farm insurance products.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. And as your farm grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.

https://datcp.wi.gov/Pages/Homepage.aspx#