Pole Barn Insurance

(Because you want the best coverage, and the best price.)

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

What's an agribusiness without pole barns? You've got to have somewhere to store your farm equipment and livestock. Making sure you have the right insurance for your barns is key in keeping your farm running without major out-of-pocket expenses. That's where an independent insurance agent is key.

Your independent insurance agent is a knowledgable resource when it comes to insuring all aspects of your agribusiness, including your pole barns. Knowing how coverage works and where to get it is essential in running a business, so let's start with a little background.

How to Insure Your Farm's Pole Barn

Insuring your farm is one thing, but your pole barn is another. Your pole barn insurance policies are typically separate from your overall farm coverage, though they can be included, depending on your insurance carrier.

First, you'll need to have your independent insurance agent look at pricing and coverages for your barn's specifications. So whether you have a multi-story decked out fancy barn you could hold weddings in or a simple one-level structure, your coverage needs to apply adequately.

Your independent insurance agent will need to know the following to get started:

- Your pole barn's specifications: What's the square footage of your pole barn? What are the finishes in the barn-like flooring, stables, and more? What materials make up your barn? When was it built? What's the barn used for?

- What is your pole barn worth: This isn't the sentimental value, but what the replacement value of your pole barn. Meaning what will it cost to replace your pole barn to like, kind, and quality?

- What preemptive protection do you have in place: Are there security cameras or alarms in place in case of theft or vandalism? Is there a fire extinguishing system in case of fire? What measures are in place to keep predators, like wild animals, out?

When to Insure Your Pole Barn

Time is of the essence. If you have an uninsured pole barn already then you'll want to get a policy in place as fast as you can get your independent insurance agent on the line. If you're looking at building a whole new pole barn, then you'll want to make sure you have insurance in place before, during and after the build-out process.

No matter where you're at in the pole barn process, your independent insurance agent is just the person to help you through it all. They'll make sure you have the right coverage for your specific barn, and its needs.

How Much Does it Cost to Insure a Pole Barn?

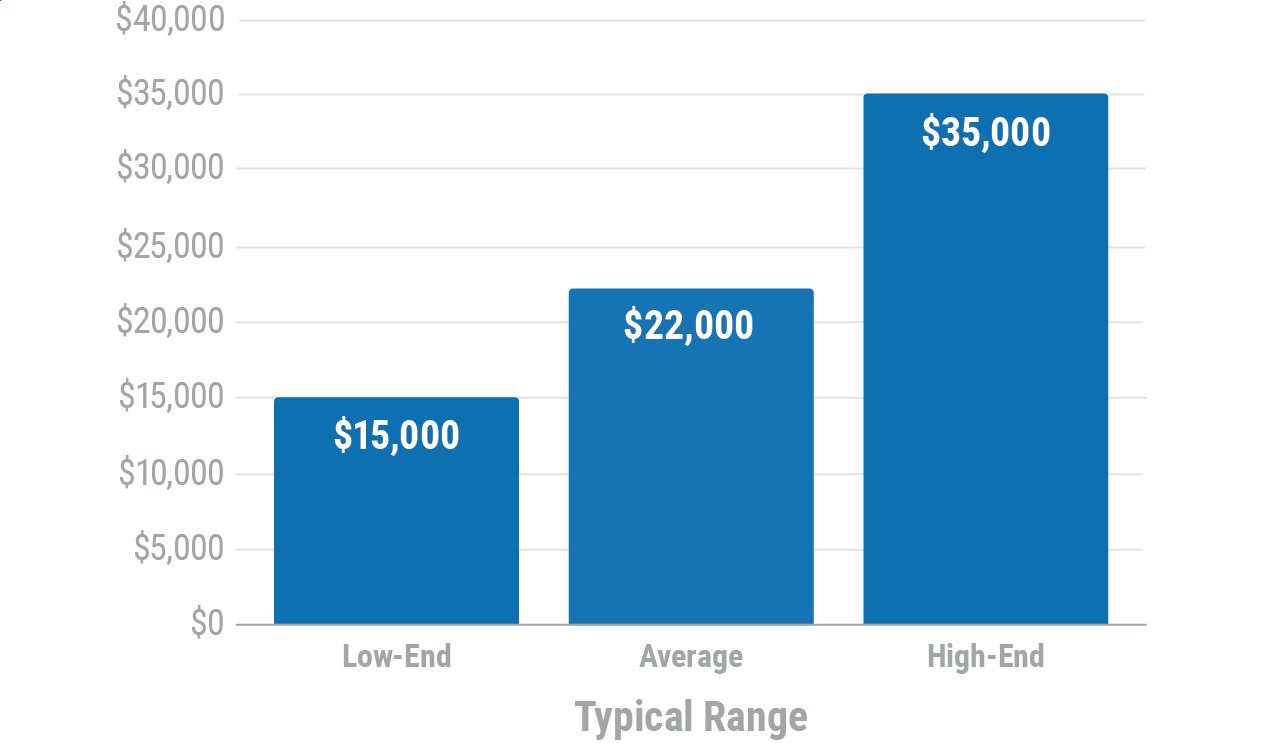

Take a moment and gather some cold, hard facts on pole barn numbers in the United States. The cost you could spend on pole barns is no joke and it's worth the look. And as expensive as they can be to build, the cost of insurance is definitely worth it to protect your operations.

Average Pole Barn Prices

The cost of insuring your pole barn, however, is dependent. It's dependent on the specifics of your pole barn, what your barn is worth and how much coverage you exactly need. Every farmer has different needs and as such comes different pricing. Speaking with your independent insurance agent will get you exacts on coverage and cost.

What Does Pole Barn Insurance Cover, and What Does It Not?

When it comes to insuring your pole barn you should have a pretty good idea of what goes into it by now. But what you need to know now is what the policy will actually cover and what it won't.

What your pole barn insurance generally covers:

- Accidents: This can be coverage for fire damage, smoke damage or things of a similar nature.

- Natural disasters: Volcanic eruption and sinkholes. Typically floods and earthquakes are covered under a separate policy.

- Weather events: Lightning, wind, hail, tornados and more.

- Crimes and civil unrest: This is for your theft and vandalism of your pole barn.

- Replacement of your pole barn: This provides coverage for you guessed it, your pole barn, so if any of the above claims occur then you will get either full replacement cost, the market value of the item or the depreciated value of your pole barn. This is all dependent on your policy specifics so discuss with your independent insurance agent.

What your pole barn insurance doesn't cover:

- Natural wear and tear: This is, well, life and insurance policies aren't maintenance policies so best to be prepared.

- Farm equipment and heavy machinery: This will be covered under a separate policy or under another coverage under the main farm policy.

Pole Barn Liability Insurance

If you’re found to be legally responsible for causing bodily injury or property damage to other people or their property as a result of them being in your pole barn, you’ll have coverage under the liability portion of your policy. Between that and all the other coverages your farm policy provides, looks like you'd be in pretty good shape.

Your independent insurance agent can discuss all facets of your farm and pole barn policies making sure you've got the proper coverage in every area. If your use of the pole barn is a large risk, they may recommend umbrella coverage to help increase your protection.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility and competitive pricing while working for you. And as your farm grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find a local independent insurance agent in your community here.

https://homeguide.com/costs/pole-barn-prices