What to Know about Agribusiness Insurance

(All the whos, whats, whens, wheres and whys that you may, or may not, know about your insurance.)

Candace Jenkins is a licensed insurance advisor with over a decade of experience. She is also a writer and loves to write on all things insurance. Candace writes for TrustedChoice.com on a continuous basis and is here with the facts about all your insurance inquiries.

Owning an agribusiness is no easy task, so why make insuring it a chore on top of it all? Let an independent insurance agent take the burden off your tanned shoulders and help you better understand your farm policy, its coverages, costs and how to make sure it's got exactly what you need to keep your operation running smoothly.

An independent insurance agent can get in the weeds when it comes to your agribusiness insurance. They are knowledgeable, trusted, and can always help you find the best blend of coverages at the perfect cost for your budget. But first, here are a few important things you should know about farm insurance to get you off on the right foot.

What Qualifies as an Agribusiness?

According to tax rules, an agribusiness means the keeping or boarding of five or more horses or the production within a state of agricultural products, including but not limited to field or orchard crops, livestock, dairy, or poultry or the products thereof, where the keeping, boarding or production provides at least $2,500 in annual gross sales to the operator for exemptions issued prior to July 1, 2002.

Simply put, though, an agribusiness is basically any farm that makes a profit off the goods it produces, whether that's dairy, beef, or hemp. Commercial farms operate on many different scales and have been the backbone of America since the beginning, which means they are priceless and should be protected.

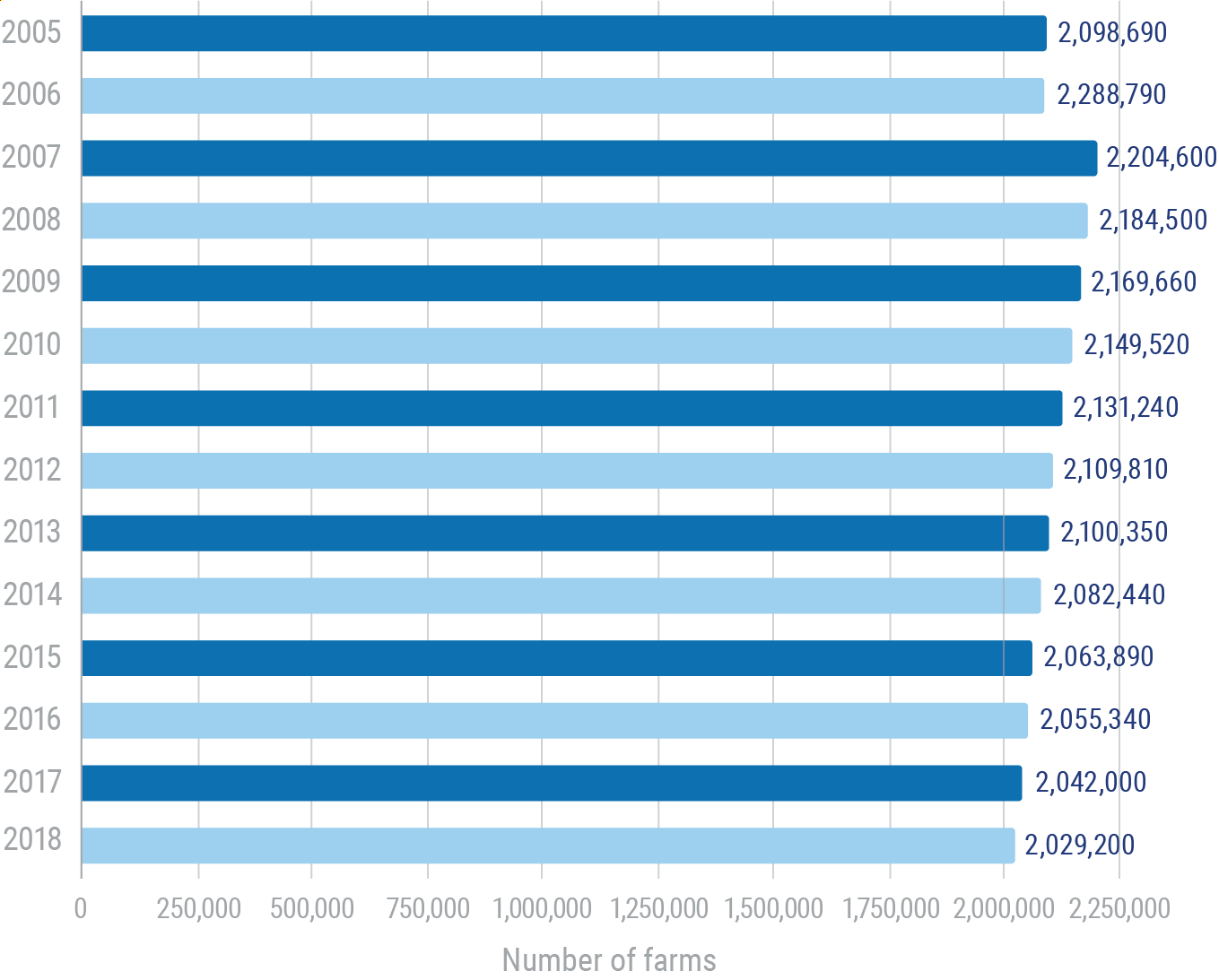

Number of Farms in the United States 2005-2018

But what many in more urban areas may not realize is that a farm is not only a business, but it's also a home in many cases, which means it requires special insurance protection that more or less combines home and business insurance into one. Not to mention all the great little add-ons like equipment coverage and crop coverage as well.

What Does and Doesn't Agribusiness Insurance Cover?

Your agribusiness insurance policy starts with a broad range of coverages that include common necessities for farm owners. From your pole barns, to your crops and livestock, to your equipment and tractors, your farm policy has you covered. Beyond that, there are also additional coverages that can join your policy to help cater more specifically to your needs.

Common Included Farm Coverages:

- Farmhouse: Covers your home on the property, like any homeowners insurance policy would. But with farm insurance, it's grouped into the one policy.

- Livestock: Covers the replacement of your livestock due to injury or death if, say, your cattle got attacked by a coyote or caught in a barbed wire fence.

- Crops: Covers your crops against bad weather that may wipe out them out. Some may even have coverage for pests.

- Equipment and machinery: Covers most of your tractors, combines, threshers and so on. Additional coverage may be needed, so make sure you talk to your independent insurance agent about your specific needs.

- Barns and other structures: Covers your barns, equipment buildings, pole barns and more.

Extra Farm Coverages Worth Considering:

- Fire: Yes, it seems like it would be covered automatically because, hey, it's a farm, and fire is a pretty common coverage. But whether this coverage is automatically included has a lot to do with your carrier, your access to a fire department, and how easy your fire can be put out. If your fire department is only a mile down the road, great! But if your pole barn is 25 acres down the property with no road or ease of access to put out that fire, that can be a problem. Your independent insurance agent should take a walk around the land prior to writing the policy to make sure you've got your bases covered, literally.

- Fencing: Since fencing ranges in price and quality, it's normally an endorsement that gets added on to the policy so you can be sure you have enough and the right amount of coverage for your fenced-in farm.

- Windmill coverage: Covers the value of any windmills on your property destroyed or damaged by a covered event.

- Silo coverage: Covers your grain and corn storage if it's damaged by a covered event.

- Bee coverage: Not protection from bee stings, it's protection FOR your bees. If you operate a honey-producing, beekeeping farm, protecting the queens and their workers is a must.

And on the business side:

- Loss of business income coverage: Protects you if there’s some sort of business interruption, replacing lost income and providing operating expenses to keep you grinding away.

- Workers' compensation coverage: Protects your workers and employees from sickness, injury, or worse as the result of a job-related accident. WARNING: Every state has different guidelines and requirements, so talk to your agent about the requirements in your state.

- Commercial vehicle coverage: Protects the big rigs, transport trucks, and trailers that you have to run your business.

- Commercial umbrella coverage: Extends the coverage limits of liability claims beyond your standard farm policy's limits. If you have a lot of visitors on your farm or your products end up in a large number of houses and restaurants, it's a good idea to increase your liability coverage with an umbrella policy.

- Goat yoga: So you want to start a calm and cool outdoor yoga oasis where visitors can come and partake of exercise and goats. There's coverage for that, as crazy as it may sound.

- Public field trips: If busloads of kiddos are coming to see your dairy farm, then you'll need to make sure there's coverage in place for having the public on your property.

- Pumpkin patch: If you need insurance for a public pumpkin patch pickin' farm, there's a policy for that, and your agent can put you on the right path.

Every Farmer Should Know the Most Common Agribusiness Claims

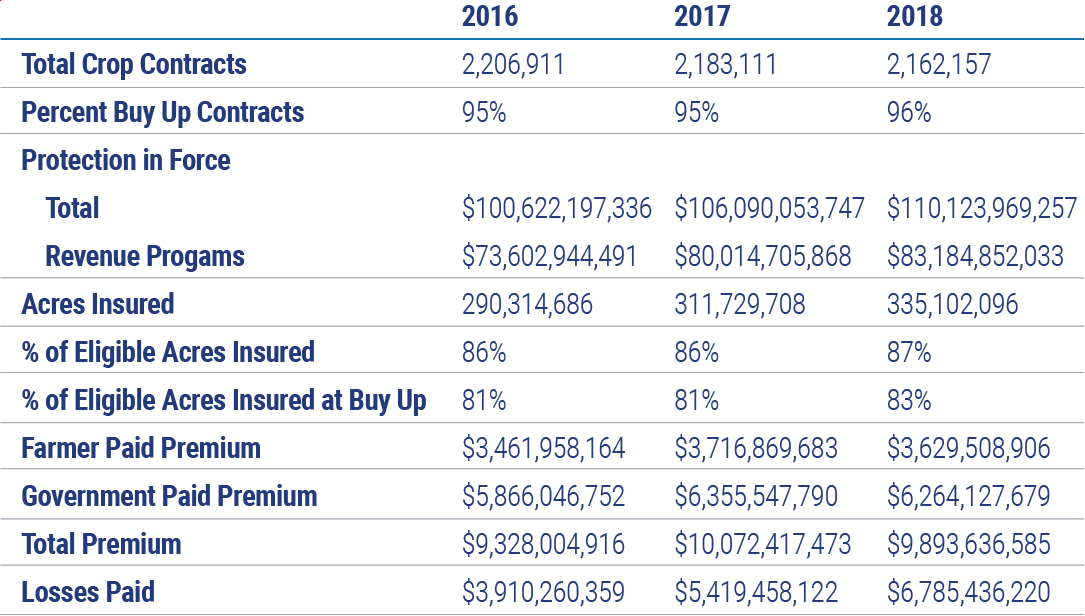

Many agribusiness claims can arise and have arisen on American farms, but one in particular seems to be paid out more than others, and it's also the fruit of your labor as a farmer, your crops. They are what you've been working so hard to produce, and it's also a common claim for crop insurers. That's mainly because a lot can happen to your crops during the planting, growing and harvesting seasons. You'll want in-transit coverage as well to make sure your crops make it to the finish line. Check out the snapshot below for some cold, hard crop facts.

US Crop Insurance Claims over the Years

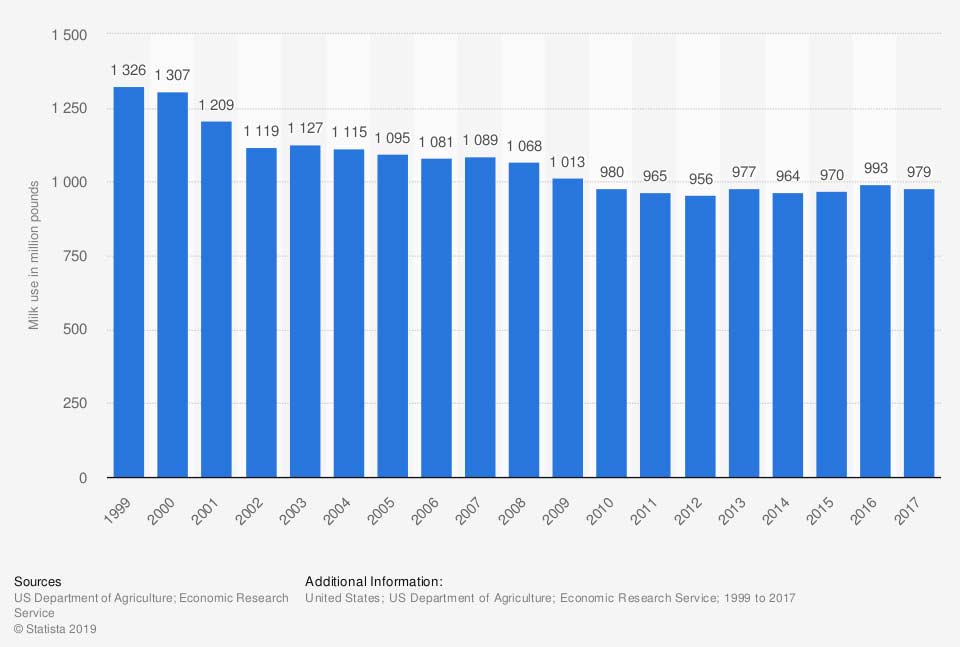

Another item that can lead to some claims is your product itself. Take a peek at how much milk is produced, according to a recent study. That's a lot, and since there's no use crying over spilled milk, you better find a way to protect it with insurance.

Quantity of milk used on farms that was produced in the US from 1999 to 2017 (in million pounds)*

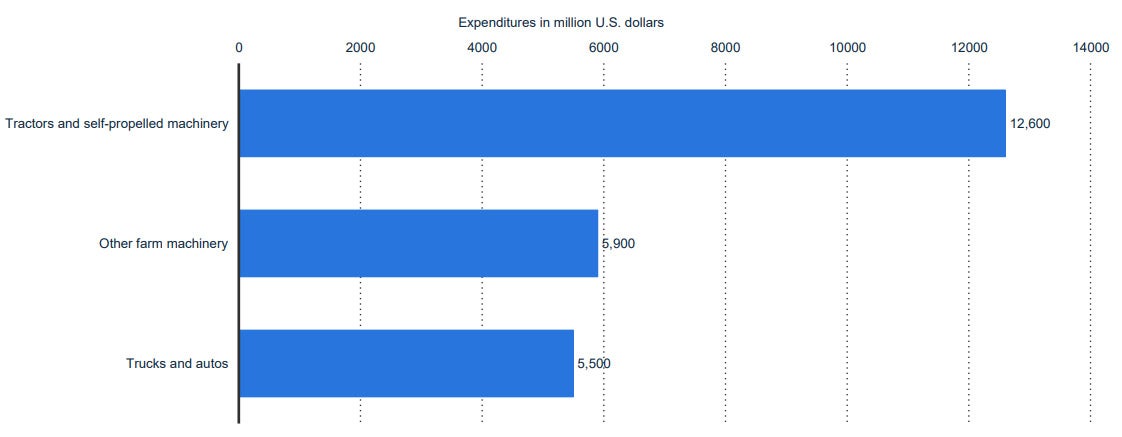

Farm equipment and machinery are in high demand, as you can see in the chart below. After all, it's used to run and work every inch of your farm, and there's a lot of room for error when claims are involved. It just takes one bad claim and that expensive tractor could make or break your operation.

Farm production expenditures on machinery by US farms in 2017, by type (in million US dollars)

How Much Does Agribusiness Insurance Cost?

Agribusiness insurance rates can be costly, but it all depends on your farm's specifics. Having a good idea of the following before your conversation with an independent insurance agent will help get you a fairly accurate estimate.

Items that impact your commercial farm insurance premiums:

- Number of acres: How much land you have will cause pricing to go up or down. The more you have to insure, the more premium you will pay.

- Barns and other structures: The number of barns and other structures and their size and quality will factor into your cost.

- Production: What you grow, harvest, produce and sell will also influence premiums. It costs more to insure a tobacco farm than a wheat farm. The type of item and the more inherent risk before, during and after production of that product will affect pricing.

- Farmhouse: The size, quality, and features of the home on your commercial farm will also impact your pricing.

- Equipment and machinery: Both motorized and unmotorized property like tractors, threshers, and other equipment will need insuring, and the replacement cost on some of those pieces could be high, which will impact rates.

- Workers: The farmhands and workers of any kind that you hire to run your farm will impact rates, because you'll not only have more liability from employing people, but you'll also need to add a workers' compensation policy.

Every Farmer Needs to Know What Kind of Losses They Can Expect

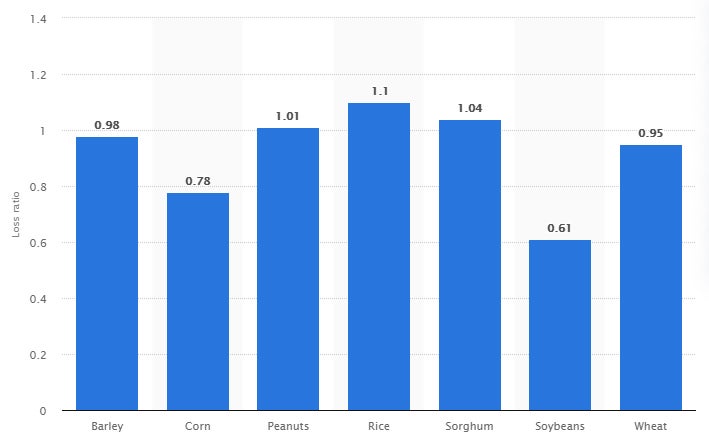

According to a recent study, the number of claims and payouts of those losses could actually save you money in the long run. What is nice about farm insurance is, yes it will cost you premium upfront, but it will save you way more than you put in when you actually have to use it. Take a look at some figures on loss ratios for US crops.

Loss ratios from 2001 to 2017 on US crops

Which Carrier Has the Best Farm Insurance?

It's only natural to want the best, and why shouldn't you have it for your farm? Well, finding the best insurance carrier can be a daunting task if you go it alone. Because what's best for you may not be best for every commercial farmer across America. Having a knowledgeable independent insurance agent in your corner is your best option. They work with carriers of all kinds every day and know all about the most reputable carriers with the best farm insurance products.

The Benefits of an Independent Insurance Agent

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility and competitive pricing while working for you. And as your farm grows and your needs change, they'll be there to help you adjust your coverage, up or down, to make sure you're properly protected without overpaying. Find an independent insurance agent in your community here.

https://www.statista.com/statistics/196103/number-of-farms-in-the-us-since-2000/

https://www.statista.com/statistics/649465/total-losses-paid-by-crop-insurers-usa-by-state/

https://www.statista.com/statistics/196103/number-of-farms-in-the-us-since-2000/