Auto Insurance for Sports Cars

Here's where to find affordable, high-performance car insurance that keeps up with your vehicle.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

Not all cars or insurance policies are created equally. For those drivers who prefer higher-value, typically faster and sleeker vehicles, they'll need an insurance policy that can stand up to the increased risks. A standard auto insurance policy likely won't be enough.

Luckily, an independent insurance agent can help you find the right protection for your sports car at the best possible price. They'll make sure you get equipped with all the coverage your specific ride needs. But first, here's a bit of background on the insurance you need to protect your sports car or hot rod.

What Do Insurance Companies Consider to Be a Sports Car?

There are several key factors that insurance companies consider when it comes to defining a sports car. Most providers evaluate this on a case-by-case basis, though some are the same from one carrier to the next.

Common factors that define a sports car:

- Make and model: The brand of vehicle and how it runs is one of the main determining factors.

- Cylinders and horsepower: More speed and horsepower often lead to more accidents, raising the risk factor.

- Price: Cars with higher price tags can assume higher rates due to the cost to repair or replace them.

- Height and weight: Generally, sports cars have a lower profile and weigh less, making them quick and highly maneuverable.

Here are some specific characteristics of sports cars, as defined by car insurance companies:

- Two-seaters

- Turbocharged engines

- Higher horsepower

- Small and lightweight compared to standard sedans

- Soft backs

Sports cars are further differentiated from other cars by their luxury aspects and higher price tags. But insurance companies ultimately may end up running your vehicle's VIN and checking specifics to see if it technically qualifies as a sports car.

Some of the most common sports cars include:

- Porsche 911

- Subaru WRX

- Dodge Challenger

- Toyota TRD

- BMW Coupe

- Honda Civic Type R Touring

- Audi R8 Coupe

- Chevrolet Camaro

- Ford Shelby

- Chevrolet Corvette

- Lamborghini

- Ferrari

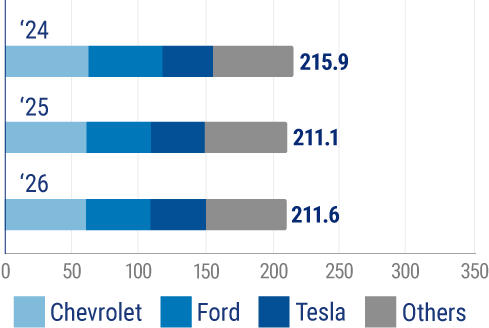

Sports Car Sales in the United States

Estimated/forecast sports car unit sales in the U.S. from 2024 to 2026 by make (in thousands).

As of 2023, Chevrolet, Tesla, and Ford are among the top-selling sports car brands. Sports cars are known to be some of the most expensive cars on the market. As a result, most car companies have a sports model vehicle in their car lineup.

What’s the Difference between Sports Car Insurance and Standard Car Insurance?

The biggest difference is the risk that's involved. By nature, when you're driving a car that has more power, you're more likely to drive faster. The faster you drive, the more at risk you are to have an accident.

Since car insurance is primarily based on how high your risk factor is, your necessary coverages and rates need to increase to compensate. Plus, if you had to replace your vehicle after an accident, that would cost more, too.

Some common sports car risks not typically associated with standard vehicles include:

- Performance: Any vehicle that can accelerate at a fast pace, stop quickly, and enter turns at high speed is riskier for obvious reasons.

- Expensive to repair: If you have a foreign or imported vehicle, just finding parts and certified repair shops can be difficult, time-consuming, and expensive.

- Theft: Thieves often target sports cars, and if stolen, they're likely to cost more to replace.

- Age of driver: Younger, less-experienced drivers are often more attracted to fast, sporty vehicles. Younger drivers are statistically more likely to get involved in traffic accidents or get ticketed for speeding.

An independent insurance agent in your town can help you find the right kind of auto insurance for your sports car.

What Does Sports Car Insurance Cover?

Just like standard auto insurance, sports car insurance provides collision coverage and liability coverage. Most full-coverage sports car insurance policies, though, are a combination of:

- Liability coverage: Pays for bodily injury treatment costs and property damage to someone else, their vehicle, and/or property as a result of an accident.

- Collision coverage: Pays for damage to your car from a collision with another driver, regardless of fault.

- Comprehensive coverage: Pays for damage to your car due to a non-collision event such as a flood or theft.

While this is a common auto insurance package, there are also a variety of coverages that can be added to protect against unique risks. Some of these include:

- Medical payments coverage: Pays for the cost associated with injuries to yourself or your passengers if you get involved in an accident.

- Personal injury protection (PIP): Pays for the cost of personal medical bills after an accident you cause and can also cover lost wages or child care expenses.

- Roadside assistance: Pays for the costs of getting a tow truck or other roadside service if your car breaks down on the road.

- Umbrella insurance: Pays for costs that exceed your car insurance's limit, up to increments of $1 million.

An independent insurance agent can help you find a car insurance policy that includes every type of coverage you need.

How Much Does Sports Car Insurance Cost?

Not only do the make, model, and engine size of your car affect the cost of your policy, but other factors like your location, gender, age, driving history, and how often you drive your vehicle also impact your rates.

On average, though, you can expect sports car insurance to cost an average of $2,270 per year. This is quite a bit higher than the national standard car insurance average of $1,311 per year.

- Sports car insurance average rate per year: $2,270

- Standard car insurance average rate per year: $1,311

But rates vary by insurance company, as well. An independent insurance agent can help you find the most affordable coverage in your area.

Where Can I Find the Cheapest Sports Car Insurance?

This can be tricky to answer since sports car insurance rates vary not only by insurance company but also by the make and model of your vehicle. Trends show that certain sports cars are often the cheapest to insure by nature, including:

- Mazda MX-5 (Miata)

- Hyundai Veloster

- Fiat 124 Spider

- Ford Mustang

Considering these are statistically the cheapest sports cars to insure, next, we'll compare average rates from some of the top-rated car insurance companies for each model.

Mazda MX-5 Miata Sports Car Insurance Rates

| Car Insurance Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $1,848 |

| Nationwide | $1,004 |

| Progressive | $1,657 |

| USAA | $1,239 |

Hyundai Veloster Sports Car Insurance Rates

| Car Insurance Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $2,054 |

| Nationwide | $1,112 |

| Progressive | $1,730 |

| USAA | $1,264 |

Fiat 124 Spider Sports Car Insurance Rates

| Car Insurance Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $1,798 |

| Nationwide | $883 |

| Progressive | $1,671 |

| USAA | $1,175 |

Ford Mustang Sports Car Insurance Rates

| Car Insurance Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $1,835 |

| Nationwide | $1,237 |

| Progressive | $1,977 |

| USAA | $1,260 |

How to Save Money on Sports Car Insurance

When it comes to protecting your sports car, you already know insurance rates are much higher than for a standard vehicle. But with the right tips at hand, there are ways you can help lower the cost, such as by:

- Keeping a clean record: Maintain a good driving record and credit score to lower your auto insurance rates.

- Being over 25: Once you turn 25, your insurance rates tend to lower.

- Raising your deductible: With a higher deductible, your premium rates can be lower.

- Putting safety first: Make sure your car has a number of safety features like anti-lock brakes, airbags, and anti-theft to earn discounts on insurance.

- Driving it less: Use a standard car for everyday use and only drive your sports car on special occasions to keep your rates lower.

- Bundling coverage: Use one insurance company to insure all your vehicles, your home, and other property.

- Comparing wisely: An independent insurance agent can bring multiple quotes to the table to review, and you can pick the one that works best for your budget.

Enlisting the help of an independent insurance agent is one of the easiest ways to score any and all possible discounts you qualify for on sports car insurance.

How We Chose Our Top-Rated Sports Car Insurance Companies

Trusted Choice considered dozens of car insurance companies that also offer sports car insurance coverage when selecting only the best. We chose our top contenders by comparing each carrier's:

- AM Best financial strength ratings

- Better Business Bureau ratings

- Customer reviews

- Customer service availability

- User-friendliness

- Products offered

- Discounts available

- Average rates

When you want to find the best sports car insurance around, you don't want to waste your time browsing through tons of different quotes from carriers you may not have even heard of. That's why we selected just a handful of the best sports car insurance carriers for you to start with.

The Benefits of an Independent Insurance Agent

Insurance policies can be complex, and searching through company after company can be time-consuming and frustrating. An independent insurance agent can greatly simplify the process.

They work with multiple insurance companies on a daily basis, so they know all the pros and cons of each one and can help you find the best blend of coverage and cost. Plus, they'll break down all the insurance jargon and fine print to make sure you're confident you've got the right coverage for your sports car's unique needs.

https://www.bankrate.com/insurance/car/sports-car/

https://www.thezebra.com/auto-insurance/vehicles/sports-car-insurance/

https://www.statista.com/chart/27914/sports-car-sales-in-the-united-states/